Will the United States or China Lead in Humanoid Robotics?

Five Scenarios on the Road to Mass Manufacturing

Hello, I’m Ylli Bajraktari, CEO of the Special Competitive Studies Project. In this week’s edition of our newsletter, SCSP’s Gillian Hodge and Brady Helwig discuss how the United States and China are positioning themselves in humanoid robotics.

🎤 Exciting Announcements

We are excited to announce that our upcoming AI+ Robotics Summit on October 23rd in Washington, DC will feature a special video message from filmmaker James Cameron! Sign up for the waitlist here!

Keith Strier, Senior Vice President, AMD and Dr. Chris Miller, Professor of International History at the Fletcher School at Tufts University and Senior Advisor to #SCSPTech, will join us at The Ash Carter Exchange in Cambridge, MA on November 1st. Join the waitlist here!

SCSP x AGI House Hackathon: SCSP is partnering with the Bay Area AI hacker house, AGI House, to host an AI Agents for Gov Hackathon @SCSP’s office in DC! Come create the future of AI agents to solve important real-world challenges. Request attendance here.

Will the United States or China Lead in Humanoid Robotics?

Five Scenarios on the Road to Mass Manufacturing

Dockworker strikes across the East and Gulf Coasts earlier this month – the first strike among longshoremen and associated dock workers in nearly 50 years – highlighted America's fractious relationship with automation and robotics. These frictions will deepen as large technology firms and startup companies move towards their stated goals of deploying humanoid robots, or general-purpose robotics with a human form factor, at scale. As U.S. investors and the Chinese government pour resources into humanoid robotics, will we see widespread deployment in both nations by the end of the decade? And will America’s lead in generative AI translate into robotics leadership, or will China’s position as the global manufacturing powerhouse give it the edge?

Assessing China’s Robotics Progress

The robotics industry traces its roots to the late 1950s, when an American inventor, Joseph Frederick Engelberger, and his business partner, George Devol, formed the world’s first robotics company, Unimation. Inspired by science fiction author Isaac Asimov, Unimation successfully deployed their prototype robotic arm at a General Motors assembly plant in New Jersey. Since the mid-20th century, the deployment of industrial robots in factories has enabled firms to operate with increased speed and productivity, while also sparing human workers from hazardous work. The 1970s, in particular, saw a sharp increase in the use of robots and automation as a general purpose technology.

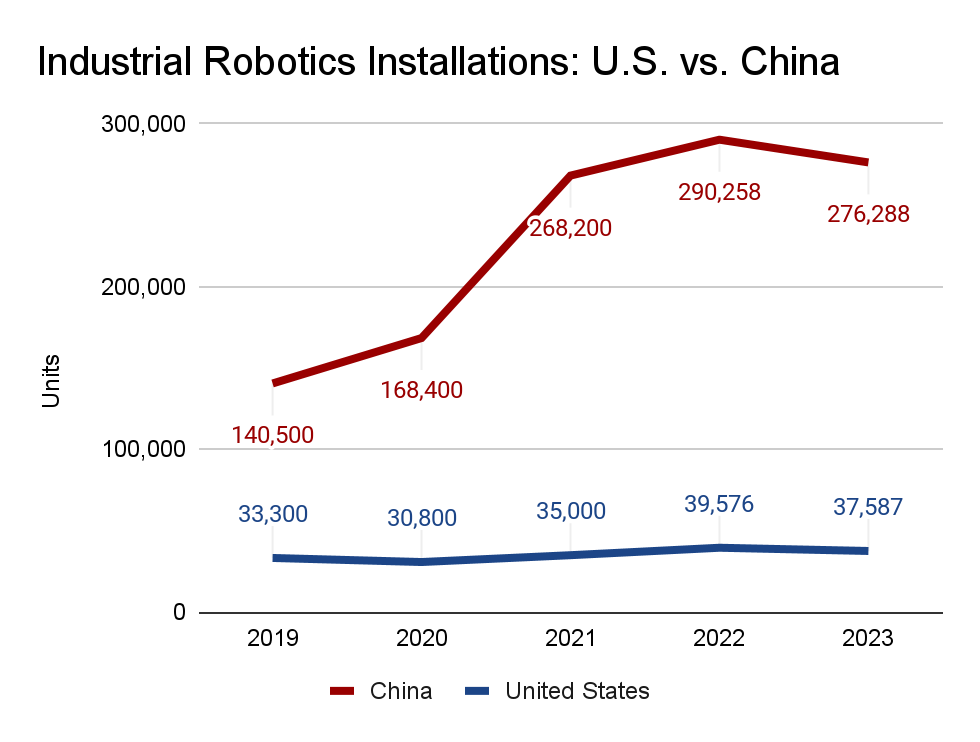

Today, however, none of the “Big Four” suppliers of industrial robot arms are based in the United States. Despite much of the innovation in this field taking place domestically, the United States lags behind other industrialized nations in robotics production and deployment. Over the past ten years, annual robotics deployment in the United States has grown slowly, from 27,500 units deployed in 2015 to about 37,500 units deployed last year.

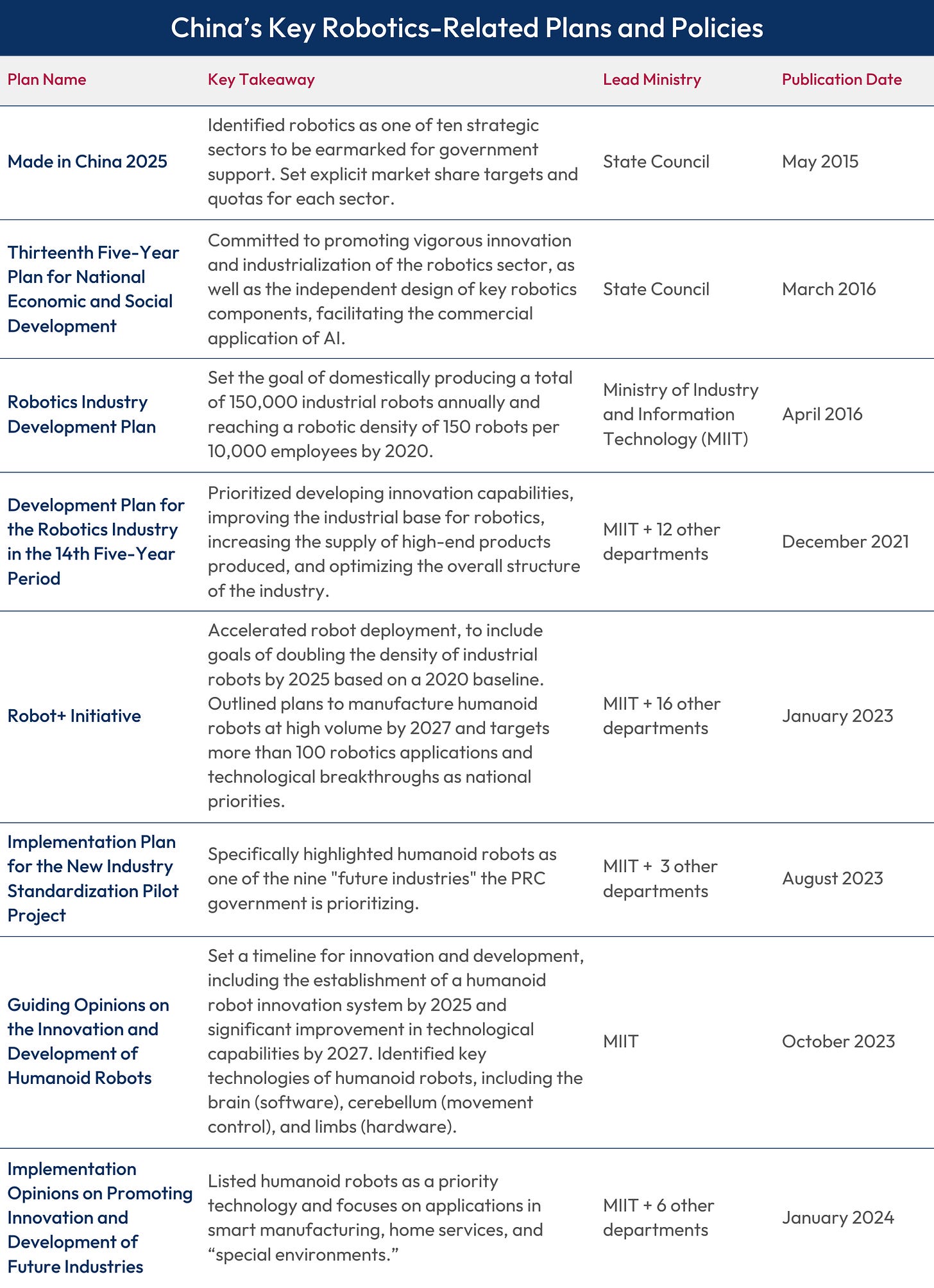

In recent years, the People’s Republic of China (PRC) has become the world’s leading deployer of industrial robotics by a wide margin. Beijing recognized the industry as crucial for addressing the country’s demographic crisis nearly a decade ago and has launched multiple industrial plans focused on the sector. These include the "Made in China 2025" initiative, which identified robotics as one of ten strategic sectors in need of government support, and multiple Five-Year Plans for the robotics industry. In 2023, Beijing launched the “Robot+” Initiative. The initiative set ambitious goals to double the density of industrial robots per worker by 2025, outlined plans to manufacture humanoid robots at high volume by 2027, and targeted more than 100 robotics applications and technological breakthroughs as national priorities. This high-level support has launched China as the global leader in robotics deployment: last year, PRC firms deployed as many industrial robots as the rest of the world combined.

Although China has long been the world’s largest importer of robotics, it has also made notable strides in domestic production. In the first half of 2024, Chinese firms filled more than half of the nation’s domestic robotics demand for the first time. In one key subsector, collaborative robotics, Chinese firms have lapped their competitors and now account for about 86% of domestic market share. One major milestone was the rapid 2016 acquisition of German “Big Four” robotics giant KUKA by a Chinese manufacturing conglomerate, which saw Chinese shareholders increase their voting power from 5% to nearly 95% in a single year. The KUKA takeover served as a stark warning to the United States and its allies and partners about the need for stricter investment screening and highlighted China’s desire to secure the means of production in robotics.

Developing Humanoid Robots: Body + Brain

Building a Humanoid Robot

The concept of a humanoid robot, or automata, has captured the popular imagination for thousands of years, with roots steeped in both eastern and western civilizations. Both Greek myth and Chinese philosophy feature ancient accounts of the creation of humanoid automatons that served as servants or warriors. Recent developments in generative AI may have finally laid the groundwork for widespread deployment, building on the foundation laid by technological progress toward the creation of working humanoid robots that picked up during the late 20th century. Creating robots with a human anatomy allows them to better navigate operating environments designed for human workers, while offering a more natural and intuitive mechanism for human-machine cooperation. Deployment at scale may be the only way for the United States and other industrialized nations to cope with rapid demographic change and crippling workforce shortages in strategic sectors. In manufacturing, for example, the United States faces a projected shortage of 2.1 million workers by 2030 that threatens to derail efforts to rebuild its industrial base. Deploying robots to fill even a portion of this gap would boost lagging productivity. Proponents of humanoid robotics have also called for deployment in fields traditionally reliant on person-to-person exchange such as healthcare, education, and customer service.

Creating a functional humanoid robot requires solving both hardware and software problems that have vexed researchers for decades. Hardware, the “body” of a robot, must be designed to be both durable and mobile, with a sufficient power source to complete assigned tasks. Hardware models differ greatly across the industry. While the moniker “humanoid” implies two arms, a torso, two legs for bipedal movement, and a head, the nature of these features varies greatly. Some models are only sophisticated enough for basic “walking,” while others can lift heavy objects or even perform acrobatics. Ultimately, though, most models require a relatively straightforward set of hardware components: high-capacity lithium-ion batteries as a power source; an alloyed aluminum or steel body cavity; a LiDAR scanner and a variety of other sensors to “see,” “hear,” and “feel”; advanced GPUs to perform AI inference, or draw conclusions from data; and a variety of industrial components to power working joints, including electric motors, harmonic gearings, and planetary roller screws.

While a number of companies have developed working hardware, software, on the other hand, is considered the key to successful deployment and adoption of humanoid robots. Software serves as the “brain” of a humanoid and accounts for roughly 80% of any robot's value. Industrial robots, such as SCARA (Selective Compliant Articulated Robot Arm) models, are pre-programmed to perform repetitive tasks. Humanoid models, however, must adapt to and navigate dynamic environments in real-time. The advent of generative AI has unlocked multimodality – an AI system’s ability to fuse data from different kinds of sensors and sources – which in turn has been key to moving the concept of humanoid robots closer to reality. The most significant challenge to widespread deployment over the past decade has been developing methods to train robots that can perform reliably despite scarce real-world data, but a variety of firms are developing training methods for robotic foundation models that collect multimodal data, process it, and then formulate a response in real-time.

Scaling Humanoids: The Race to Mass Manufacturing

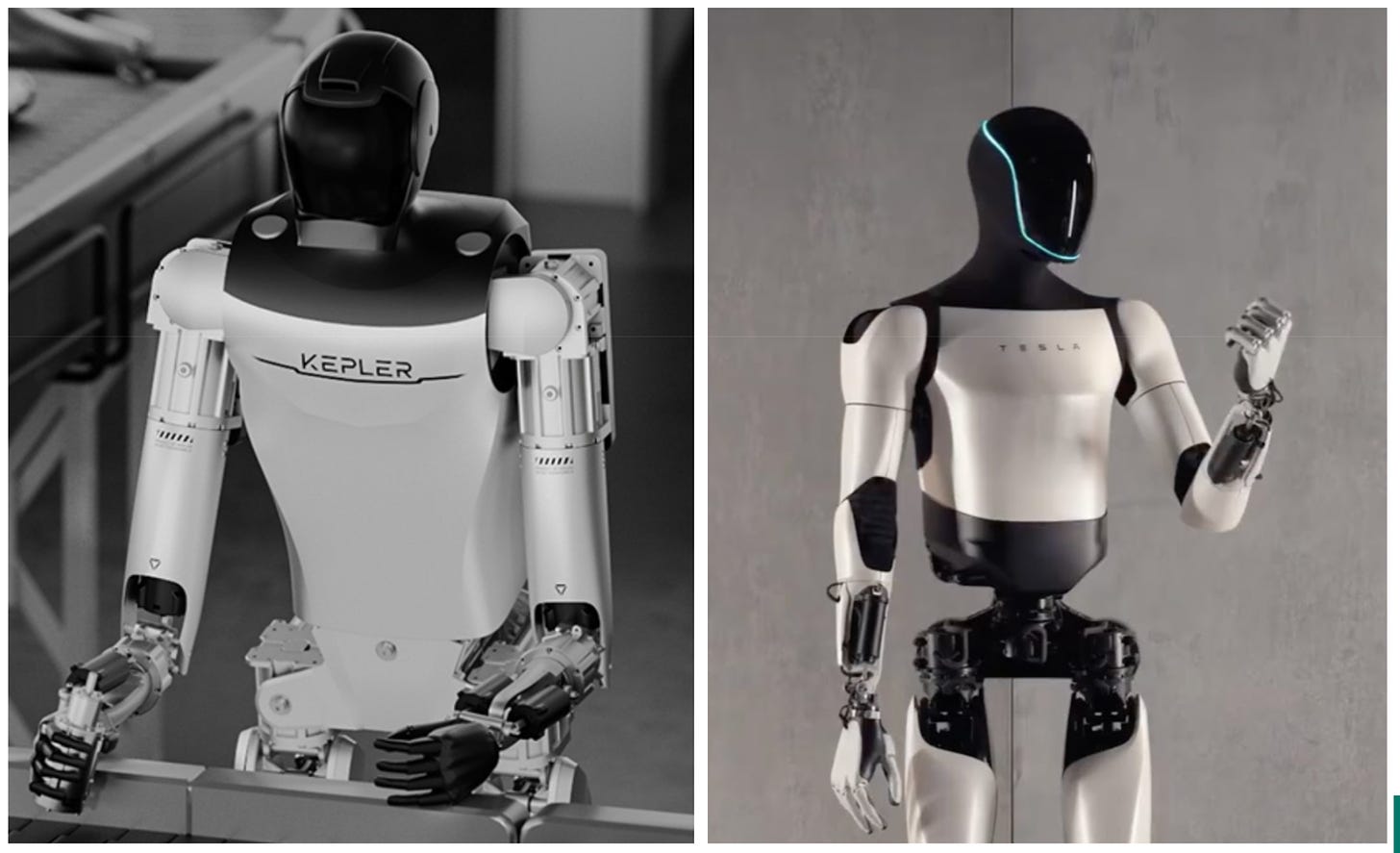

Widespread deployment of humanoids within the next decade appears increasingly feasible. U.S. venture-backed humanoid robotics startups have raised billions of dollars in venture funding over the past several years, including angel investment from tech luminaries like Jeff Bezos and Sam Altman. These firms have also announced major partnerships with top global automakers, including BMW and Mercedes-Benz, and several have deployed humanoid robots in factory and warehouse settings for early trials. OpenAI, Nvidia, Amazon, and several well-funded startups are working to translate breakthroughs in generative AI into robotic foundation models, which would serve as the “operating system” for humanoid robots. For their part, Chinese policymakers have targeted mass production of humanoids by 2027, and domestic industry leaders seem poised to deliver. Twenty-seven humanoid robot models reportedly made their debut at the World Robotics Conference, hosted in Shanghai in July, evidence of a large and well-funded industry.

Will we see the takeoff in humanoid adoption that investors, CEOs, and startup founders promise? Here are five plausible scenarios to watch that would shape whether humanoids are widely adopted and whether the United States or the PRC will lead.

Technical capabilities: robotic foundation models and corresponding training methods are perfected, allowing for reliable performance in unstructured environments. To merit deployment at scale, humanoid robots must respond predictably, reliably, and safely in real-world environments. This same challenge has plagued the deployment of autonomous vehicles over the past 15 years. These technical issues stem from the central problem of insufficient training data and methodology. Compared to other forms of AI, from text and video-based transformer models to computer vision systems, real-world multimodal data – especially in industrial settings – is much harder to come by. A variety of alternative data sources and new methods to train embodied AI models on real-world data have been proposed; the company that can crack the code could take a definitive lead. This is an area where the U.S. has a clear advantage.

Cost: price per unit declines dramatically while capabilities steadily improve. Assuming technical problems can be solved, the question of whether humanoid robots will see widespread deployment within our lifetimes will be dictated in part by economics. Picture a robot that costs $150,000 per unit, plus another $50,000 to maintain and operate over the course of its lifespan. If such a robot operated for 20,000 hours (roughly 2.5 years), the system’s total cost of ownership would be equivalent to paying a worker $10 per hour. The final cost depends on a number of inputs, including the bill of materials and the cost of procuring data for and training a robotic foundation model. Earlier this year, Goldman Sachs estimated that manufacturing costs had declined to the $30,000-150,000 range, a 40% decrease year-over-year. Elon Musk, who hopes for the deployment of Tesla’s Optimus model by the end of 2025, estimates it to sell for around “half the price” of a Tesla car, or between $25,000-30,000 (a similar price point to Tesla’s recently revealed robotaxi). Achieving this milestone would hinge on taking advantage of inexpensive Chinese manufacturing.

Manufacturing capabilities: China’s dominance of downstream supply chain inputs – such as batteries – cements it as the world’s manufacturing hub for humanoids. Even if the United States achieves a breakthrough in AI and software that underpins widespread deployment of humanoids, China’s emergence as the global manufacturing hub for robotics would offset that leadership. China’s humanoid companies intend to pursue a “fast-follower, rapid scaling” strategy, an approach that would align with PRC advantages and strategies across other industries. One estimate suggests that China’s general-purpose robots are roughly 80% as capable as industry leaders, but are also 30% cheaper. Shanghai Kepler Exploration Robotics, whose founder was inspired by Tesla’s Optimus humanoid, claims that it will soon be able to mass produce its model for under $30,000. These cost advantages can be chalked up to a variety of factors, including forced technology transfer and massive subsidization. In January 2024, for example, the city of Beijing launched a $1.4 billion state-backed robotics fund. In July, Shanghai announced a $1.4 billion fund specifically for humanoid robots.

National security: the United States and other democratic market economies block robotics produced in China from their markets. The U.S. Department of Commerce recently proposed a ban on the import of connected vehicles from China and Russia, based on the rationale that vehicle connectivity systems and automated driving systems could be exploited by foreign adversaries to exfiltrate data and disrupt vehicle operations. These same concerns apply to robotics, including both industrial and humanoid models. Manufacturing is already the most-targeted industry by malicious cyber actors, and importing hundreds of thousands of robots from China for use throughout the American manufacturing, logistics, and transportation sectors would significantly increase these threat vectors. Commerce has indicated that robotics is a high-priority risk area and may propose a similar rule restricting imports from China and other foreign adversaries in the future.

Adoption: U.S. cultural and political attitudes towards robotics grind deployment to a halt. The strikes at U.S. ports demonstrate that some unions increasingly view automation as a nonstarter. Based on recent polling, citizens in the United States and other western countries tend to have more negative outlooks on the effects of automation than Asian countries. Public adoption of robotics depends on trust and having justified confidence that the machines will function as intended, which in turn will require that these systems exemplify democratic values in the way they are designed, developed, and deployed. One way to thread the needle is to focus robotics deployment on sectors that are facing significant workforce shortages, such as manufacturing, as well as on strategic sectors that require productivity increases to be competitive internationally. In addition, policymakers, industry, and union leaders can help ensure workers have access to training in how to use these systems and have a seat at the table as companies move toward adoption.

Will History Repeat Itself?

In 1966, when Unimation’s Engelberger was invited to Japan to lecture on industrial robotics, the reception was overwhelming: some 700 Japanese executives attended his lecture. The firm went on to form a joint venture with Japanese heavy machinery-manufacturer Kawasaki shortly after and scaled the production of their technology in Japan over the next two decades. This case study holds an important lesson for today’s policymakers as firms begin to scale manufacturing of humanoids: even when original breakthroughs take place domestically, production determines market leadership. Regardless of whether widespread deployment of humanoids takes years or decades, the stakes are too high for the United States to allow China to dominate robotics manufacturing.