Hello, I’m Ylli Bajraktari, CEO of the Special Competitive Studies Project. In this edition of 2-2-2, SCSP’s Brady Helwig, PJ Maykish, and Abigail Kukura make the tech competition case for why we need a National Action Plan for U.S. Leadership in Compute and Microelectronics.

The goal of this document is to set in motion key actions that the United States can take now – through institutions like the National Semiconductor Technology Center (NSTC) – to position our country to scale and integrate novel compute paradigms, like quantum and neuromorphic computing. We have consulted top leading exports on this issue and appreciate all the feedback we have received.

This plan is not a blueprint to build fabs in the United States, nor does it outline a path forward for export controls. Instead, it is intended to build on those existing efforts by proposing big moonshots we need to aim for in the post-Moore’s Law era. Please provide us with your feedback!

Want to be a part of our annual holiday event? Share our newsletter with your network at the button below, and the most shares will receive two invitations.

A Memo to the President on U.S. Leadership in Compute and Microelectronics

Steady progress in microelectronics over the past 55 years has enabled an exponential increase in computational power, or compute. Compute gains, in turn, have powered the deep learning revolution in artificial intelligence (AI) over the past decade, leading to step-changes in AI performance and to the emergence of generative AI and large-scale foundation models. Today, microelectronics underpin competitiveness across all other technology battlegrounds, from advanced networks to next-generation energy platforms. As Moore’s Law reaches its limits, however, further investment in compute moonshots and the microelectronics innovation pipeline is needed to stay ahead.

The United States has long been the epicenter of compute and microelectronics innovation. By the early 1980s, U.S. innovation in new methods for chip design split the production of microelectronics from their design, resulting in the rise of “fabless” chip companies that designed their own chips but had them produced at external foundries. This shift unleashed tremendous innovation, paving the way for highly innovative companies like Nvidia. But as the world’s most advanced chips reached the nanoscale, producing microelectronics became much more complex and expensive, leading key players to drop out. Today, 90 percent of the world’s advanced chips are produced on Taiwan’s western coast.

Since 1965, the microelectronics industry has roughly followed the trajectory of Moore’s Law – the prediction that the number of transistors on a chip would double about every two years, effectively doubling compute power. Yet Moore’s Law as traditionally understood is on its last legs, with transistor scaling likely to reach its limits in the coming years. With the decline of Moore’s Law, the microelectronics industry – and, by extension, the future of compute – has reached an inflection point that U.S. policy must account for. Otherwise, the United States risks investing large amounts of national resources in technologies that have reached the top of the S-curve.

Geopolitical Context

As overarching techno-economic competition between the United States and China intensifies, compute and microelectronics have gained outsized geopolitical significance. In recent years, semiconductors have edged out oil as China’s largest import, totaling $415 billion in 2022. As part of its one-way decoupling strategy, Beijing has poured tremendous amounts of resources into catching up with firms based in the United States and allied nations. These efforts are starting to bear fruit: in August 2023, Huawei released its Mate60 Pro smartphone powered by a 7 nanometer chip, raising concerns that Chinese firms are capable of innovating despite U.S. export restrictions on semiconductor manufacturing equipment.

For advanced compute, competitive domains include:

Quantum Computing: While the United States remains the global leader in quantum computing, this technology remains a contested space. PRC efforts span four of the most common hardware approaches: superconducting, photonic, neutral-atom, and trapped-ion systems. There are some indications that Chinese research in superconducting qubits may be reaching approximate parity with the United States, though details are murky. Through recent advancements in domestic production, the PRC is diminishing its dependence on imported dilution refrigeration systems, which has been a crucial chokepoint for its development of superconducting quantum computers.

Neuromorphic Computing: Since the early 20th century, engineers have sought to develop computing systems inspired by the human brain. Realizing this paradigm could unlock next-generation approaches to AI, especially for edge applications such as drones and autonomous vehicles. Beijing has prioritized neuromorphic computing and relevant brain research in recent Five-Year Plans. Both U.S. and Chinese companies have launched commercially available neuromorphic chips, but scaling true neuromorphic architectures may require the development of new software stacks and new algorithms based on approaches like spiking neural networks (SNNs).

High-Performance Computing: Reports suggest that the PRC may be reaching approximate parity with the United States in this space. The two nations developed exascale supercomputers within roughly a year of the other. However, reports suggest that the PRC intends to build 10 exascale supercomputers by 2025, while the United States is likely to only build three. The PRC has stopped reporting its progress in supercomputing to the world’s leading high-performance compute index, making a gaps assessment more challenging.

For microelectronics, current competitive domains include:

AI & Datacenter: U.S.-headquartered Nvidia dominates the global market for Graphics Processing Units (GPUs), the specialized AI chips typically used to train large-scale AI foundation models. However, nearly all of Nvidia’s AI chips are produced at Taiwan-based chip giant TSMC. PRC companies have made progress in designing GPUs domestically, but leading candidates remain several years behind. On October 7, 2022, the Executive Branch released export controls aiming to prevent China from using AI chips produced with U.S. tools, IP, and know-how for military and surveillance applications. These rules were tightened further last month.

Memory Chips: PRC industrial policy in semiconductors has been most successful in memory. YMTC and CXMT, both PRC national champions funded under Beijing’s 2014 IC Plan and Made in China 2025, have emerged as significant players. Despite U.S. restrictions, YMTC has developed the world’s most advanced NAND memory chip, edging out U.S.-based Intel and Micron and South Korea-based Samsung.

Legacy Chips: PRC firms are building out massive production capacity in legacy chips. These chips are far from outdated and include the larger nodes (usually defined as more than 28nm) that power everyday devices, including 95 percent of all semiconductors in cars. American and European firms have long enjoyed strong positions in this space, but industry data suggests that the PRC will produce over 30 percent of all chips larger than 22nm by 2025. PRC legacy chips are produced with the aid of expansive subsidies, allowing PRC firms to undercut and outcompete foreign competitors operating under market conditions.

Wide Bandgap Semiconductors: Over the past 40 years, innovators in the United States developed chips made with novel materials, like gallium nitride, that became key enablers for networking and energy technologies. Beijing has recognized that dominating this space would enable China to strengthen its vertically integrated electric vehicle (EV) value chain while contributing to dominance in wind turbines and solar panels. Earlier this year, Beijing placed export controls on gallium and germanium, key minerals needed to produce these chips.

Advanced Packaging: Packaging, the stage in semiconductor production where components are pieced together and placed in a protective casing, has become more important as chipmakers move towards building chips in 3D. Currently, firms like TSMC and Intel lead in advanced packaging, but just 3 percent of advanced packaging capacity is located in North America. China has a large packaging national champion, JCET, but the firm currently lags behind its competitors technologically. Both the United States and China have identified advanced packaging as a strategic technology worthy of government support.

In 2022, Congress passed the CHIPS & Science Act, intended as a generational investment in U.S. technology competitiveness. The package includes $39 billion to bolster the microelectronics supply chain, with much of the funding going towards the construction of several leading-edge logic fabs – realizing the vision for multiple sources of domestic manufacturing articulated by the National Security Commission on Artificial Intelligence. But CHIPS funding also included $11 billion for chip R&D and workforce development. It is this program that will help determine whether the United States keeps its technological lead in microelectronics over the next 20 years.

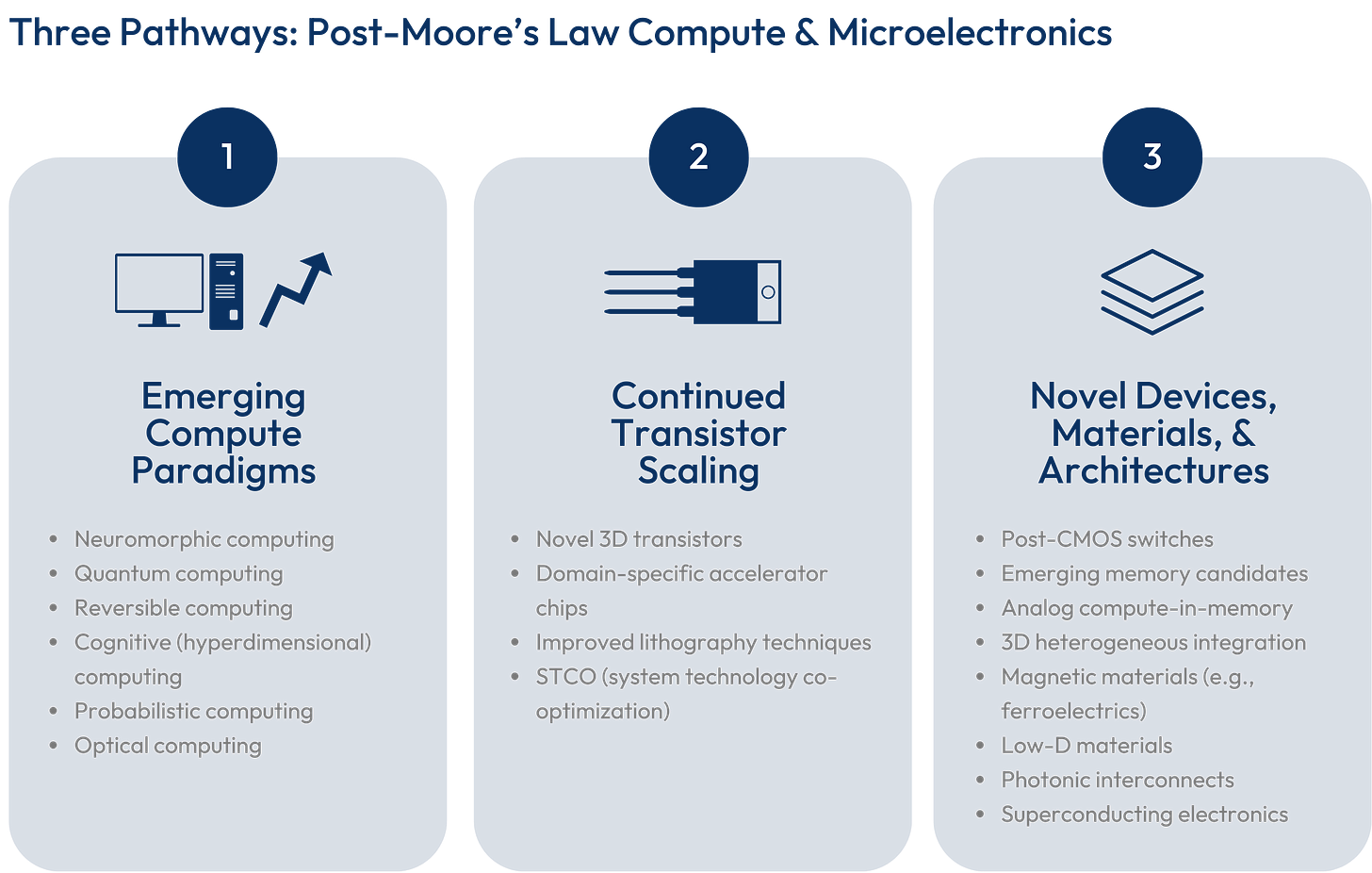

Against this backdrop, SCSP has issued a National Action Plan for Compute and Microelectronics. The plan argues that the United States should adopt an aggressive “moonshot” approach to develop and integrate future compute paradigms while building a robust innovation pipeline to scale breakthroughs across the microelectronics stack, especially in materials and devices. This strategy should be coupled with supporting actions to strengthen the microelectronics innovation ecosystem.

1. Set Moonshot Technology Goals for Compute.

New compute modalities are emerging that could have outsized geopolitical impact and drive the microelectronics ecosystem. U.S. leadership requires setting audacious goals to lead the world in developing, scaling, and integrating emerging compute paradigms.

Hybrid computing: As new forms of compute emerge as viable, the nation that develops a method to integrate multiple compute modalities into a single system and apply it to hard problems will gain an outsized advantage.

Develop a one million qubit quantum computer by 2028: Progress in quantum computing is accelerating and we expect viable, large-scale quantum systems to emerge this decade.

Improve compute energy efficiency by 1,000x to 1,000,000x: The United States should develop devices, materials, and novel compute paradigms that offer dramatic increases in energy efficiency.

Lead superconductor electronics: These novel circuits underpin promising pathways in emerging paradigms like quantum, neuromorphic, and reversible computing and hold the potential to unlock brain-like architectures that could lead to a step-change in AI performance.

2. Organize: Close Gaps in the Microelectronics Innovation Ecosystem.

The CHIPS Act establishes the National Semiconductor Technology Center to anchor the microelectronics innovation ecosystem. If implemented effectively, the NSTC can serve as an institutional home for moonshots and play a key role in scaling innovation across the microelectronics and compute stack.

DARPA-like model for NSTC: The NSTC should be granted the freedom and flexibility to pursue an independent research agenda, hire project managers backed by an in-house technical staff, and partner with other government programs and with industry.

NSTC investment fund: The CHIPS Act has authorized the NSTC to set up an investment fund focused on ensuring U.S. technology competitiveness in microelectronics. To ensure success, such a fund should focus primarily on early-stage ventures, ensure proper due diligence, employ an “evergreen” funding model, and include an incubator function to nurture startups as they navigate the innovation ecosystem. President Biden’s recent executive order directing the NSTC to “increase the availability of [CHIPS] resources to small firms and startups” is a step in the right direction.

3. Research: Fund and Attract Microelectronics R&D.

The $11 billion authorized for CHIPS R&D programs is a good start, but this funding is set to expire in 2027. Sufficiently vetting post-Moore’s Law technology candidates requires sustained public and private R&D funding.

Fuel public compute and microelectronics R&D for long-term competition: Commit to sustained increases in R&D funding for microelectronics and related fields to unlock new compute paradigms and de-risk innovation across the microelectronics stack.

Crowd in industry R&D funding via tax policy: Tweaking the R&D tax credit and allowing rapid equipment expensing would crowd-in additional industry R&D dollars.

4. Scale: Enabling Technologies for Future Compute & Microelectronics.

Leadership across the compute stack depends on key tools and infrastructure. These enabling technologies create strategic positions that the United States must occupy.

AI-enabled design tools: Generative AI enables supercharged chip design tools that use natural language as an input. Scaling these tools, especially for nontraditional paradigms, could cut the time it takes to design a chip from months to weeks.

Build digital twins for microelectronics R&D: Digital twins allow for high-fidelity modeling of complex physical phenomena, shrinking the timeline from innovation to commercialization.

Scale the Materials Genome Initiative for AI-enabled materials discovery: The development of generative AI – coupled with the promise of quantum-enabled materials modeling – have created an opportunity to supercharge the development of novel materials.

Advanced packaging leadership: As the United States builds additional packaging capacity, prioritizing innovation can provide a force-multiplier for leadership. Driving the development of an open chiplet ecosystem would unleash American innovation.

Reshape microelectronics fabrication via fab-in-a-box approaches: Lowering the cost and complexity of fabrication, even just for legacy nodes or microelectronic sensors, would be exceptionally beneficial.

Next-generation lithography: Launching effective public-private partnerships to commercialize technologies in the national laboratories can help the United States gain an advantage.

Offer cryogenic refrigeration as a service: Access to cryogenic refrigeration is a key constraint for scaling superconductor electronics, as well as for startups developing large-scale quantum systems. Capacity is available at U.S. federal labs.

5. Assure: International Collaboration for Secure Microelectronics.

Cybersecurity risks are spreading to the hardware layer, and rapid action is required to address them. The United States and its allies and partners have a shared interest in addressing these risks and should tackle them together.

International R&D collaboration for hardware security innovation: Jointly fund hardware security R&D with trusted partners in areas such as secure architectures, tamper-proof packaging, and hardware trojan detection. As part of this effort, establish coordinated research teams from National Technology Industrial Base countries.

Address legacy chips with like-minded partners: The PRC’s massive capacity buildout in legacy chips poses a serious threat to both critical infrastructure and the competitiveness of U.S. and allied firms. This issue could be addressed by pooling allied market demand via the coordinated use of trade tools and procurement policies.

Increase scrutiny for microelectronics in critical infrastructure: The United States could, with its allies and partners, establish a certification regime to classify chips destined for critical infrastructure as high-risk, medium-risk, and low-risk. Executive or congressional action could be taken to block chips produced in the PRC from high-risk applications.

6. People: Cultivate, Attract, and Retain Microelectronics Talent.

Talent is a crucial enabler for all national priorities pertaining to compute and microelectronics. In addition to fab workers, the United States must cultivate and attract a new generation of researchers to advance the frontier.

Attract international microelectronics talent: Over 40 percent of America’s current microelectronics workforce was born abroad. The United States must strengthen its pipeline for high-skill immigration in this key sector. The recent Executive Order on the Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence makes progress by directing the government to improve visa processes for AI talent, but a dedicated effort for microelectronics talent – along with Congressional action – is also required.

Nurture communities of engineering practice in emerging paradigms: Scaling emerging compute paradigms will require training a new generation of researchers devoted to tackling difficult problems. Providing hands-on learning opportunities for students to design their own chips can bolster these efforts and unlock innovation.

Compute and microelectronics power the digital age. As Moore’s Law draws to an end, sustaining America’s role as the global driver of compute and microelectronics innovation requires staking out positions that the nation must occupy, then taking supporting policy actions to strengthen the innovation ecosystem. Leadership in these technologies cannot be left to chance.

Save the Date!

The first-ever AI Expo for National Competitiveness will be May 7th & 8th at the Washington Convention Center.