Hello, I’m Ylli Bajraktari, CEO of the Special Competitive Studies Project. In this week’s edition of 2-2-2, we release the fifth National Action Plan. SCSP’s Brady Helwig and Addis Goldman address advanced manufacturing, a technology battleground defined by the application of artificial intelligence (AI) and other emerging technologies to the industrial sector.

Last week, we announced the first of our new AI+ Summit Series, AI+Energy Summit that will be held in Washington, DC. We are thrilled so many of you have joined the waitlist to attend! We will release the save-the-date soon for the second in the series, AI+Robotics Summit.

Memo to the President on U.S. Leadership in Advanced Manufacturing

America’s national competitiveness hinges on the ability to produce key technology products, yet this is a clear area where the United States has fallen behind. In 1980, the United States manufactured over 40 percent of global high-technology goods, compared to just 18 percent today. Recent industrial policy measures in the United States, like the CHIPS & Science Act and the Inflation Reduction Act, have focused primarily on large-scale investments to build production capacity in key industries. While these measures are crucial, a logical next step is a national effort to apply technology to manufacturing at scale.

A core set of technologies, from Industrial AI to 3-D printing and intelligent robotics, are converging to transform the nature of industrial production. The convergence of these technologies offers a path for the United States to gradually offset China’s manufacturing dominance. Technologies like AI, robotics, and additive manufacturing and their application to the manufacturing process create a new paradigm where America can compete. Such an effort could pave the way for a high-tech industrial renaissance and is necessary to ensure the United States and its allies could prevail in protracted conflict.

Assessing the State of Play in Advanced Manufacturing

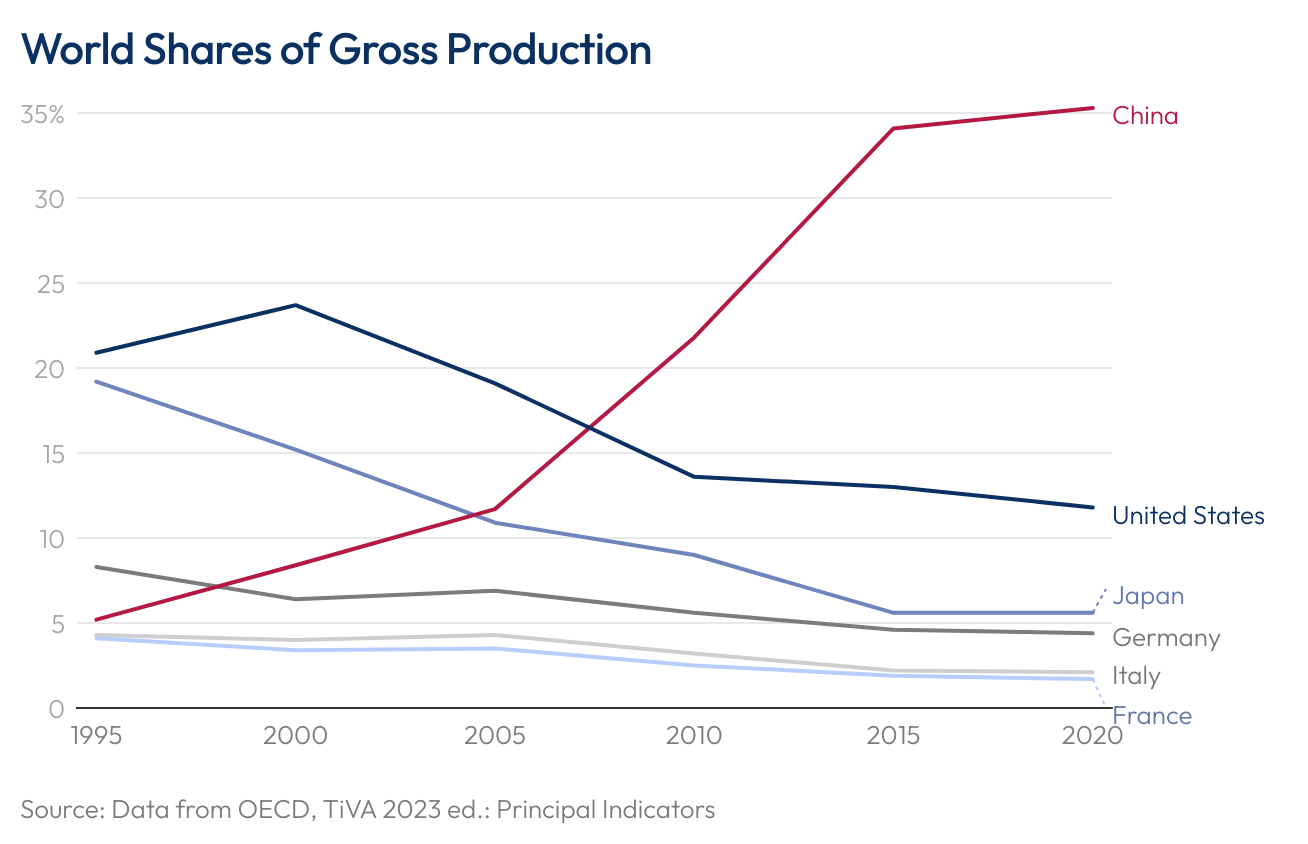

The most basic measure of leadership in advanced manufacturing is output in strategic sectors. From 1995 to 2020, China’s global share of advanced industry output increased from 3 percent to 25 percent – often at the expense of the United States and its allies and partners. China has moved from dominance in low-end manufacturing to capture significant market share across advanced industry verticals, from solar cells to electric vehicles. In many cases, the PRC has achieved outright dominance in key dual-use industrial sectors with implications for the military balance of power. In shipbuilding, for instance, China has vaulted from producing just 5 percent of merchant tonnage in 1999 to becoming the world’s leading producer of both military and commercial hulls in 2023, with roughly 230 times the shipbuilding capacity of the United States.

Key convergence technologies that are definitive for advanced manufacturing competitiveness include:

Industrial AI. Thanks to its early lead in deploying generative AI, the United States appears well-positioned for AI deployment in the physical world. At present, much of the progress has been self-organizing: America is home to a variety of innovative startups and Fortune 500 companies that are either building or deploying industrial AI solutions in innovative ways. Yet, the United States is being substantially out-organized on a national level. This is especially reflected from a data perspective because the United States lacks large-scale national programs that encourage sharing of critical data sets needed to train industrial AI models across the private and public sectors.

Robotics. U.S. academics and startups continue to set the pace globally for cutting-edge innovation in robotics; a variety of U.S. players are now vying to become the first firm to deploy humanoid robots at scale within the decade. The majority of industrial robots are produced by a handful of firms based in the EU, Japan, and South Korea. However, China leads the world in industrial robotics deployment by a wide margin: in 2023, PRC firms deployed 10 times as many robots as U.S. firms. Over the past 15 years, Beijing has targeted the robotics sector with massive state support. These efforts are beginning to pay dividends. In the collaborative robotics sector, PRC firms now make up 86 percent of global market share.

Industrial IoT. Industrial IoT (IIoT) platforms promise to allow manufacturers to leverage the benefits of integrated process automation and data analysis by serving as whole-factory “operating systems.” At present, U.S. firms offer a variety of scalable IIoT platforms that Chinese firms have struggled to match. Where Chinese firms have found their niche, however, is in the underlying hardware for these platforms. So-called IoT modules are bundles of sensors and networking components Chinese firms such as Quectel have displaced U.S. competitors and now make up over 60 percent of the market.

Advanced Networks. China jumped out to an early lead in the race to deploy public 5G networks thanks to the efforts of state-backed national champion Huawei. While U.S. and allied measures to mitigate safety concerns posed by PRC-built networking components set them back, Chinese players have again begun to find their footing as the 5G competition enters a new phase. In particular, Chinese policymakers have prioritized 5G RedCap – an emerging network standard that aims to reduce the complexity, energy consumption, and cost of 5G networks – as an opportunity to regain leadership, including in the manufacturing arena. In September 2022, MIIT also kicked off an ambitious pilot program aiming to build 1,000 “fully-connected” 5G factories.

“New Industrialization”: Beijing’s Plans to Dominate Technology Production

Beijing has recently identified manufacturing as the “main battlefield” in strategic competition and elevated it as the definitive answer to China’s declining growth and productivity. Over the past year, Chinese president Xi Jinping has emphasized the need to integrate so-called “new forces of production” (“新质生产力”), a term that harkens back to Marxist theory of production and relates to Xi’s efforts to update the theory and use advanced manufacturing technologies to transform China's growth model. In practice, this has meant a significant shift in the massive amounts of resources directed by the party-state: PRC net lending to manufacturing rose from $63 billion in 2019 to over $680 billion in 2023.

But Beijing’s prioritization of advanced industries – and specifically, advanced manufacturing – has a much longer history. In 2002, the CCP introduced a development theory dubbed "New Industrialization" (新型工业化), endorsed by then-president Jiang Zemin. In essence, New Industrialization calls for leveraging advanced manufacturing paradigms to power China’s 21st century growth. Since its introduction two decades ago, achieving high-quality development through New Industrialization and related policies, including through success in advanced manufacturing, has become one of the party-state's highest strategic priorities.

For Chinese policymakers, New Industrialization involves a two-part cycle of industrial upgrading. First, cutting-edge advanced manufacturing capabilities are developed through process innovation or industrial espionage. Then, those innovations are channeled down to upgrade China’s massive base of traditional manufacturers. As firms generate their own advancements in technologies such as industrial AI, IoT, drones, and robotics, they also leverage the advancements of other high-end manufacturers and digital service providers to increase the quality of their own products and improve their own competitiveness. These advancements then filter down the value chain, modernizing traditional industries.

Beijing's push to cultivate intelligent factories of the future has centered around three key pilot programs: one focused on smart factories in general, another targeting 5G-enabled factories more specifically, and a third focused on industrial internet platform companies. Participating companies receive a series of benefits, such as eligibility for subsidies and preferential policies, guidance on best practices for upgrading, and free publicity in state media. The state has also launched a nationwide moonshot project entitled the “Industrial Internet Identifier Analysis System” (工业互联网标识解析体系, or IIIAS), a foundational service that seeks to create a large-scale digital platform linking China’s industrial base together. If successful, such a system would grant the party-state unprecedented ability to track, monitor, and direct supply chain flows and disruptions – including in the event of armed conflict.

A Call to Action for the United States to Lead in Advanced Manufacturing

The United States is just beginning to organize for strategic competition in advanced manufacturing. We propose seven moves to further U.S. leadership in this battleground:

Launch: Moonshots to Strengthen the Industrial System-of-Systems. Novel pilot programs can help strengthen the U.S. industrial base as a whole.

Factories of the Future. A small number of cutting-edge intelligent factories already exist in the form of small startups and large original equipment manufacturers (OEMs).

Manufacturing ARPANet. Inspired by the first computer network, which was funded by the U.S. Department of Defense, creating an AI-enabled digital twin of the entire U.S. industrial base would provide unprecedented visibility into key supply chains and could shift capacity in wartime.

Organize: Close Gaps in the Manufacturing Innovation Ecosystem. Facilitate additional policy coordination and strengthen key federal manufacturing programs.

Scale and Reimagine the Manufacturing USA Program. The United States should redouble its support for its core manufacturing technology innovation programs, bringing resourcing for manufacturers more in line with spending by other industrialized nations.

Create a Data Foundry Network for Industrial AI. A networked public-private partnership could serve as a trusted hub for companies to share necessary datasets to train sophisticated industrial AI models.

Establish a White House Office of Manufacturing. A White House-level office would enhance policy coordination and bring urgency to the advanced manufacturing agenda.

Innovate: Establish U.S. Leadership in Manufacturing Technology Innovation. Incentivize process innovation by revitalizing the nation’s approach to R&D funding.

Create a Bell Labs for Manufacturing. The United States should establish a public-private “focused research organization,” modeled on Bell Labs, to accelerate manufacturing technology innovation.

Increase Advanced Manufacturing-Related R&D. The United States should devote a larger portion of its total federal R&D budget to manufacturing, bringing it closer in line with comparable industrialized nations.

Scale the Materials Genome Initiative. The United States should augment the capacity of its flagship materials discovery initiative to synthesize novel materials with industrial applications.

Promote: Accelerate Technology Adoption and Enable Scale-Up Capacity. Utilize innovative programs and financing instruments to drive adoption of advanced manufacturing paradigms.

Retool the Manufacturing Extension Partnership Program as a System Integrator. The United States should enable its flagship public-private program to increase the competitiveness of small- and medium-sized manufacturers (SMMs) by accelerating the deployment of advanced technologies at scale.

Close Capital Access Gaps for SMMs. The United States should consolidate and leverage tax policy and credit and loan financing mechanisms to close capital access gaps for SMMs seeking to digitalize.

Create a National Network for Additive Manufacturing. The Department of Defense should scale a distributed, 3-D printing-enabled production network to mobilize in times of national emergency.

Leverage Large-Scale Financing Mechanisms to Bolster Domestic Production. Scaling capital-intensive industrial enterprises requires creative use of large-scale financing vehicles, such as the Export-Import Bank, or the establishment of an Industrial Finance Corporation of the United States (IFCUS).

Pushback: Defend U.S. Markets from PRC Overcapacity. Efforts to promote U.S. manufacturing competitiveness must be paired with new trade alliances and defensive instruments to blunt the PRC’s anticompetitive practices.

Build Trade Alliances with Allies and Partners. Signing targeted free trade agreements with key allies and partners can create new markets for U.S. manufacturers while lowering the cost of critical inputs.

Leverage Section 301 to Secure Access to Critical Technology Inputs. Higher duties should be considered for hardware that is critical to advanced manufacturing systems, such as IoT modules and industrial robotics, to prevent a flood of untrustworthy components from the PRC.

Utilize Section 232 to Build Resilient Supply Chains with Allies and Partners. The United States should utilize trade tools to build a trade architecture that strengthens economic ties with allies and partners while pushing back against China’s unfair trade practices.

Defend: Cyber-Harden the Allied Industrial Base. A new approach to industrial cyberdefense is needed as digitalization expands the attack surface.

Defend the Industrial Base with Automated Cyberdefenses. Defending the U.S. industrial base against AI-enabled cyberattacks will require creating testbeds where AI-enabled cyberdefenses can be trained and deployed.

Develop Secure “Digital Threads” for Cyber-Physical Systems. Additional R&D is needed to foster technology-enabled solutions for supply chain transparency, with an end-goal of ensuring the provenance of an entire advanced manufacturing system.

Secure Supply Chains for Digital Infrastructure. Defending against adversaries requires securing each hardware and software element of the advanced manufacturing technology stack.

Cultivate: Tackle Talent Shortages and Skills Gaps. Solving the manufacturing workforce shortage must become a national priority.

Train 1 Million Manufacturing Workers with Cyber Skills by 2030. Workforce shortages persist across the manufacturing sector, but talent is especially needed at the intersection of cybersecurity, industrial systems, and AI.

Build a National Advanced Manufacturing Talent Marketplace. The United States should create a one-stop resource to match talent with job opportunities in advanced industries.

Establish an American Manufacturing Corps. An American Manufacturing Corps would create opportunities for national service by working to restore the U.S. industrial base.

Reconceptualize the “Manufacturing” Workforce. The United States must address the evolving role of workers in manufacturing environments characterized by the convergence of physical and digital technologies.

Ultimately, in order to counter China’s manufacturing dominance, the United States must do more to encourage process innovation and spur more rapid deployment of advanced manufacturing technologies. To learn more about SCSP’s proposals to boost U.S. competitiveness in this technology battleground, see SCSP’s National Action Plan for U.S. Leadership in Advanced Manufacturing.