Navigating the Competitive Frontiers of Autonomous Vehicle Technology

I’m Ylli Bajraktari, CEO of the Special Competitive Studies Project. In today’s edition of our newsletter, SCSP’s George Ngoh, a Research Assistant on our Future Tech Platforms team, discusses the current state of the U.S.-China competition in the autonomous vehicles (AV) sector.

For years technologists and engineers have promised consumers a new age of autonomous mobility, and that new era of transportation may finally be here. Elon Musk, after promising in 2016 an autonomous rate of 90% of Tesla driven miles by 2016, in June began Tesla Robotaxi fleet operations in Austin, Texas. This, on the heels of a more controlled, larger scale expansion by current U.S. industry leader Waymo which recently passed the 100 million autonomously driven miles mark in July of this year.

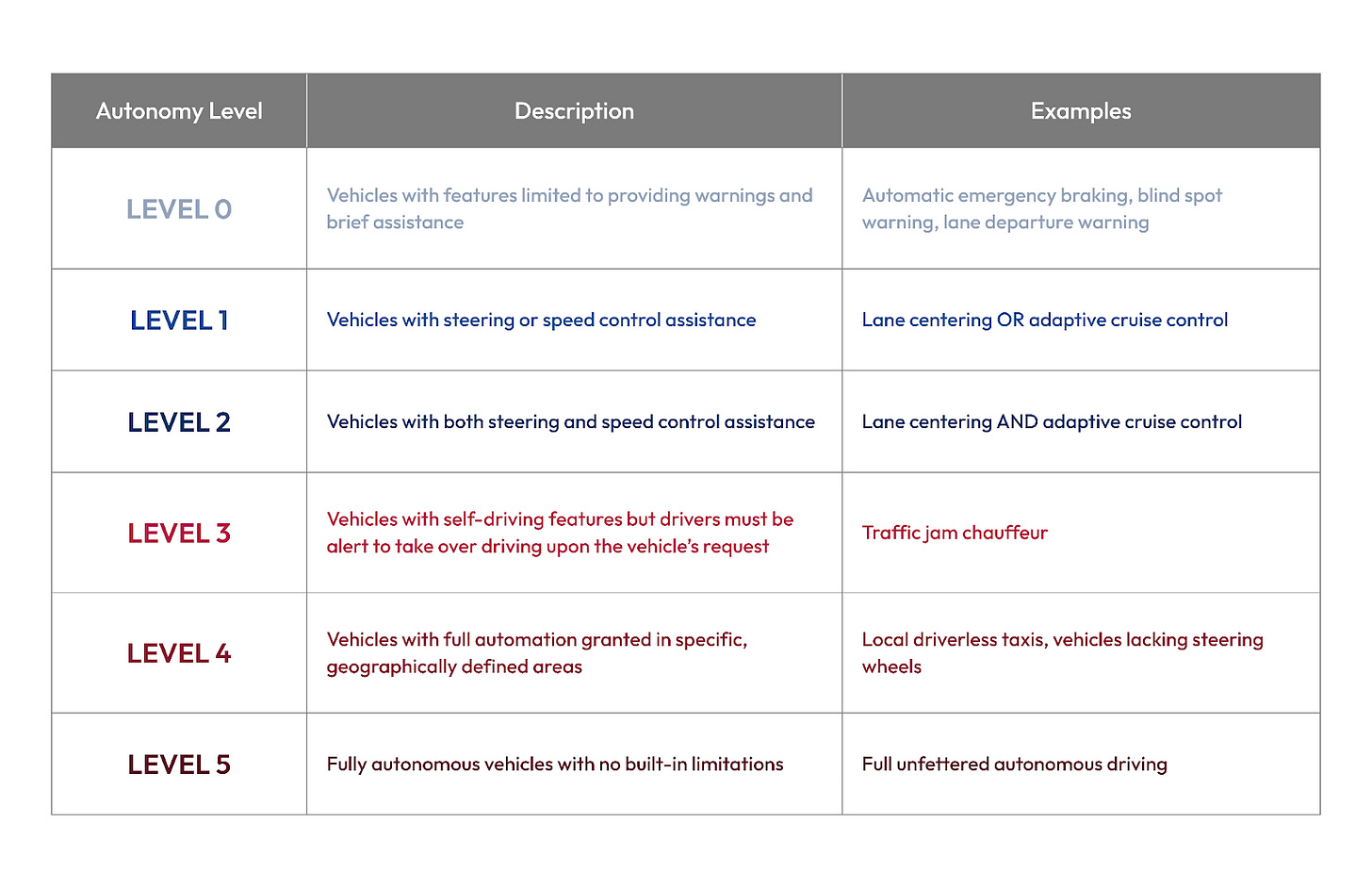

The international standard for vehicular autonomy classification is the six step SAE international scale. This scale describes autonomy levels from Level 0 to Level 5:

Globally, the number of operational vehicles with autonomous features has already seen substantial growth, nearly doubling from 31 million in 2019 to 54 million in 2024. Forecasts for 2030 anticipate that the total revenue for the fully and semi-autonomous vehicle market could exceed four trillion dollars, with fully autonomous vehicles expected to capture approximately 44.7% of that market. This anticipated large-scale adoption of AVs promises considerable benefits, including enhanced road safety, optimized logistics, and a reduced environmental footprint. These potential advantages are spurring auto manufacturers and tech companies to boost their research and development investments and expand their efforts to bring AVs to consumers.

This is more than just a commercial race. The strategic importance of AV technology is that it also possesses dual-use capabilities that can offer profound military advantages, such as improved precision for munitions guidance and fully autonomous platforms for strike, surveillance, and logistics. The AV race is fast becoming a cornerstone of the broader strategic competition between the United States and China.

The Current Competitive Landscape

The United States currently holds a slight lead in the autonomous vehicle (AV) sector ahead of China, though data and public information gaps persist in both countries. This advantage is largely rooted in the superior computational and algorithmic capabilities of American firms. However, this lead is far from guaranteed, and it is challenged by significant factors both at home and abroad.

The primary challenger to U.S. leadership comes from China, which has a likely advantage in the sheer quantity of available AV data and is rapidly closing the gap in computational power. Beijing's determination and massive investment in domestic chip production specifically for AVs are fundamentally reshaping the competitive dynamics of this space.

Meanwhile, the U.S. federal regulatory environment, which had largely taken a hands-off approach, is now facing growing scrutiny. At the subnational level, state and local governments are also playing increasingly active roles in regulating local AV deployments, and the lack of unified, stringent federal oversight, once seen as a sign of confidence in American firms, is now being challenged by recent legal precedents and mounting public skepticism. This shifting landscape of legal liability and consumer trust represents a critical, and often overlooked, caveat to the United States’ technological lead.

Growing Legal and Public Scrutiny

Just last week, a Florida court verdict against Tesla introduced a new and critical dimension to the AV race: legal accountability. For the first time, a jury found that the carmaker, not just the driver, was partly responsible for a fatal crash involving a semi-autonomous system. While the findings are expected to be appealed, these legal and public trust challenges demonstrate that the path to widespread AV adoption is not purely a technological one. To build confidence with both the public and policymakers, automakers and regulators require more than just miles driven; they need comprehensive, transparent data—especially fault data—to definitively prove the safety and reliability of these platforms.

The Crucial Role of Data

Progress in AV technology is fundamentally dependent on two types of data:

Fault data encompasses observations of errors in predictive decision-making, object perception, software glitches, and accidents.

Operational data is more routine and includes metrics on software and hardware performance, sensory data like images, and miles driven.

AVs are ultimately examples of embodied AI, “the integration of artificial intelligence into physical systems, enabling them to interact with the physical world.” As such, both data categories are critical for several reasons. For instance, fault data such as accidents per mile driven help firms, regulators, and the public to gauge the safety and reliability of AV platforms, which is essential for building trust and fostering market growth. Furthermore, when firms share some of their operational data, it can enable academic researchers to advance cutting-edge AI research without the prohibitive costs of operating their own AV fleets. In the United States, Waymo is a notable example, offering large datasets for free use by researchers and sponsoring "challenges" to spur innovation, although it retains the intellectual property rights to submitted work. This model could be a pathway for other American firms to enhance their competitiveness by leveraging broader algorithmic advancements.

Different Means to Similar Ends

The United States and China have adopted starkly different regulatory approaches to AV data, yet both have resulted in opaque information environments. In the United States, federal regulations only mandate the reporting of AV-related road accidents to the National Highway Traffic Safety Administration (NHTSA), with a trend toward less stringent crash reporting requirements. Some states, most notably California, require more detailed fault and operational data to be reported to a public database. This creates a disjointed data environment, but firms continue AV expansion in cities nationwide. Waymo, for instance, is expanding its fully autonomous taxi services, and Tesla is launching similar services. However, the total number of autonomous miles driven in the United States is still far lower than the billions needed to definitively prove reliability. Industry-backed studies on AV safety, like one recently released by Waymo, often have limitations due to data scarcity and uncontrolled variables, which complicates effective policymaking and building public confidence. The Florida court ruling further complicates this regulatory landscape, highlighting the potential for legal liability in the absence of clear federal standards. In a potential step toward addressing this, the NHTSA this week announced a new study of driver monitoring systems, a move welcomed by safety advocates.

In contrast, China's Ministry of Transport (MOT) imposes strict regulations on test data reporting, including a requirement for AVs to retain at least 90 seconds of data in the event of a crash. Despite these strict regulations, none of the operational or fault data reported to the MOT is publicly available, creating a lack of transparency. While some Chinese firms like Baidu’s Apollo have released large training datasets, there is no central, public repository for fault data.

Autonomy as a Service: A Tale of Two Markets

Large fleets are what cultivate the rich datasets necessary for AV innovation. As such, large service providing firms dominate the space in two business areas:

Mobility-as-a-Service (MaaS) which provides individuals on-demand access to various modes of transportation such as in the case of ridesharing.

Transportation-as-a-Service (TaaS) which provides individuals and firms on-demand transportation solutions such as in the case of land-based truck transportation services.

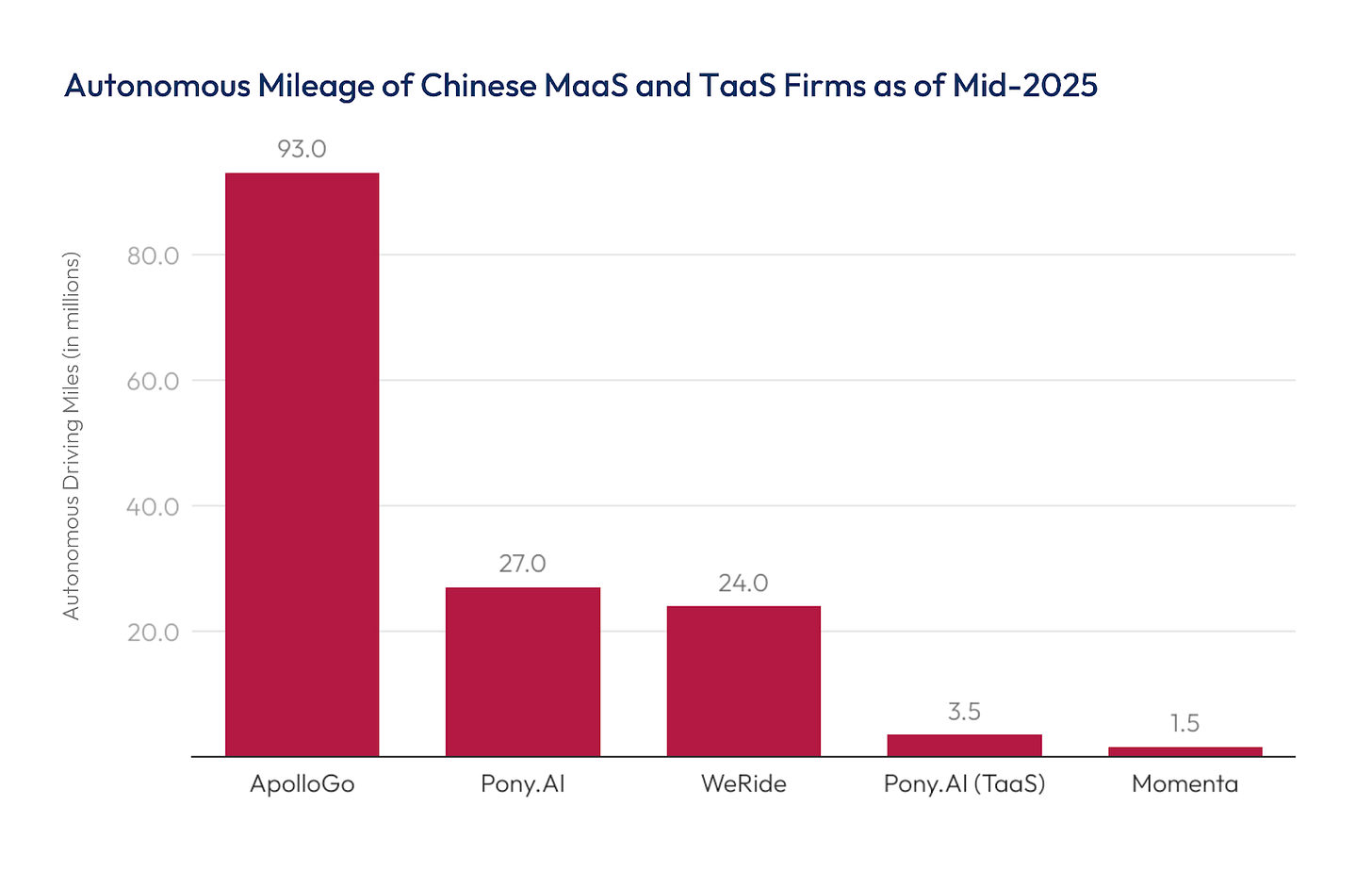

In China, the MaaS and TaaS sectors are quickly scaling. Several firms have significant AV fleets providing paid services. ApolloGo leads the MaaS firms with an estimated 1,000 vehicles and has reported over 93 million autonomous miles driven as of May 2025. Other major players expanding their fleets include Pony.AI with about 27 million, WeRide with about 24 million, and Momenta with about 1.5 million. By mid-2024, over 20 Chinese cities had permitted AV testing in designated areas, with approximately 32,000 kilometers of roads open for testing. Pony.AI is also China’s only major player in the autonomous TaaS space, achieving about 3.54 million autonomous miles by April of 2025 from a combined semi- and fully autonomous fleet of 160 trucks.

The American autonomous MaaS and TaaS environment is developing differently. While firms like Tesla and Zoox have garnered media attention, their deployments are still in the pilot phase with no disclosed mileage data. Waymo is the only large-scale autonomous MaaS firm in the country, operating in specific zones within Phoenix, San Francisco, Los Angeles, and Austin. Despite its limited operational areas, Waymo is experiencing rapid growth, doubling its autonomous mileage to over 100 million miles by July 2025 with a fleet of about 1,500 vehicles.

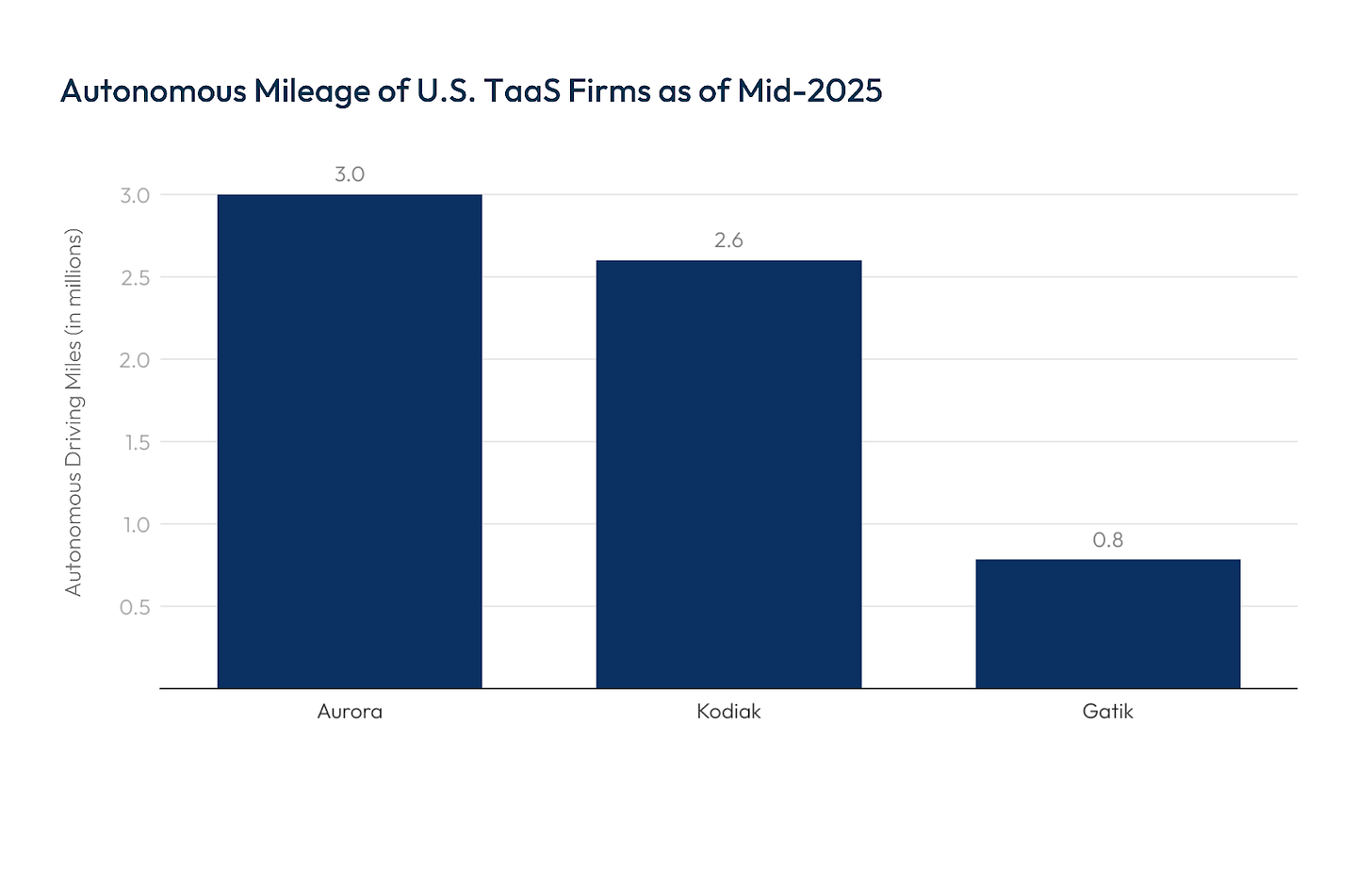

The American autonomous TaaS sector is more competitive but less developed than China's, with firms like Aurora, Gatik, and Kodiak in the early stages of commercial operations and fleet scaling. As of mid-2025, American TaaS firms have reported significantly fewer autonomous miles compared to their Chinese counterparts, with Aurora reporting 3 million miles, Kodiak reporting 2.6 million miles, and Gatik reporting 785,000 miles.

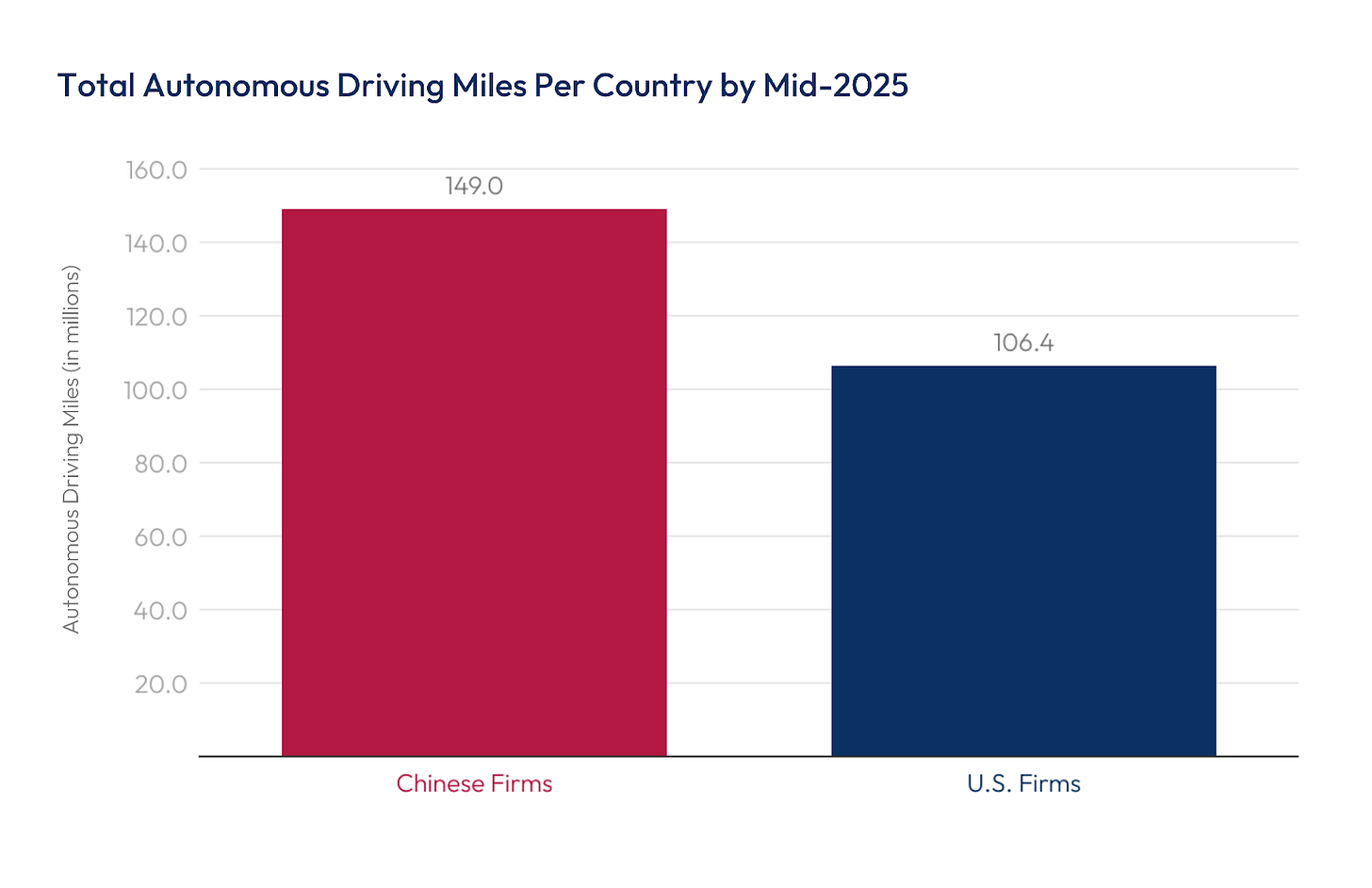

Overall, as of mid-2025, Chinese firms have reported a total of 149.04 million autonomous driving miles, more than double the 106.38 million miles reported by American firms. This indicates that China is currently outpacing the United States in operational scaling by a factor of over 1.4.

China's Computational Leap and Its Implications

Despite its lead in data collection and operational scale, China appears to lack confidence in the current capabilities and reliability of its domestic AV firms. This is evidenced by the stringent regulatory responses to accidents, such as a deadly incident involving a Xiaomi SU7 in March 2025, which led to a Ministry of Industry and Information Technology (MIIT) ban on certain marketing terms and stricter controls on software updates and public testing.

However, this situation may be on the verge of a significant shift. China's advantage in data, combined with its rapidly increasing computational capabilities, could enable it to surpass the United States and achieve dominance in the AV sector. Recent technological breakthroughs underscore this potential. For example, Xiaomi's new XRING O-1 3-nm chip places the company only two years behind Apple's most advanced offerings. Furthermore, China's state-funded chip manufacturer, SMIC, is nearing the capability to produce 5-nm chips, a size that many Chinese chip designers are already equipped to work with. For context, Tesla uses 4-nm, 5-nm, and 7-nm chips in its semi-autonomous Full Self Driving and Dojo supercomputer.

Achieving milestones in nanometer design and manufacturing will significantly enhance China's computational power. This will have a profound impact in two key areas:

More powerful onboard chips will dramatically improve the real-time sensor fusion and predictive decision-making of AVs, likely leading to the safety and reliability improvements needed for mass commercialization.

At the firm level, enhanced compute capacity will allow Chinese companies to leverage their vast data troves for more complex and diverse simulations, which is crucial for validating AV safety in new environments.

Maintaining U.S. Competitiveness

To avoid losing their tenuous competitive advantage, the United States and its AV firms cannot afford to be complacent. A concerted effort is needed to maintain leadership. AV firms should increase their investments in modeling and simulation of their platforms and software. Concurrently, state and federal governments need to work together to create unified and more stringent data collection standards for these firms. Such measures will build the necessary trust with policymakers and the public, facilitating broader domestic adoption of AVs and positioning the United States to be a leader in the global automotive market. Failure to make these investments puts significant American commercial interests and critical dual-use technology manufacturing capabilities at risk. Autonomous vehicles are not merely the future of transportation—they are a bellwether of strategic advantage in an AI-driven world. We cannot afford to fall behind.

Great work!

awesome!