The Missing Piece in China’s Innovation Power

How Beijing is Mobilizing to Build a More Self-Reliant National Innovation System

Hello, I’m Ylli Bajraktari, CEO of the Special Competitive Studies Project. In Pillar I of our most recent report, Vision for Competitiveness, we chart a path for the United States to maintain its edge in scientific and technological breakthroughs by reimagining the Endless Frontier. We identify four key moves the United States needs to implement to maintain its edge:

Organize national S&T programs,

Fund a dynamic innovation ecosystem,

Build strategic public-private partnerships, and

Modernize governance for the innovation age.

In this issue of 2-2-2, SCSP’s David Lin, Olivia Armstrong, and the Future Technology Platforms team examine Beijing’s own pursuit of the Endless Frontier. In the memo below, they unpack the Chinese Communist Party’s efforts to build a new “national innovation system” and reinvigorate fundamental R&D inside China as part of a sweeping initiative designed to position China as a global leader in science and technology.

China’s Invention Deficit

Earlier this week, China’s President Xi Jinping gave a keynote address at a high-level science and technology conference hosted at the Great Hall of the People in the heart of Beijing. Xi opened his speech by giving a nod to how innovation power plays in geopolitics: “When science and technology flourish, the nation flourishes; when science and technology are strong, the nation is strong.” Innovation power is a nation’s ability to adapt, adopt, and invent new and emerging technologies. China’s core competencies in manufacturing have enabled it to adapt to shifting supply chains, and lead globally in adopting, scaling, and deploying these technologies. A command over these two aspects of innovation power has propelled China to the forefront in strategic sectors such as electric vehicles, solar panels, and digital infrastructure. Thanks in part to China’s significant investment into its manufacturing industrial base, it has become a global leader in iterative development or “process innovation.”

The missing piece in Beijing’s innovation power however, is invention, or the ability for a nation to develop breakthrough discoveries and field generation-setting, first-of-a-kind platforms. In the same speech, Xi heralded some of China’s latest S&T achievements in the life sciences, quantum technology, and space technology among other fields. While China’s achievements to date are notable milestones of a scientific superpower-in-the-making, they still fall short of the S&T prowess long-held by the United States and other leading innovation nations. According to Xi, “Although China’s scientific and technological undertakings have made significant progress, its original innovation capabilities are still relatively weak, with some key core technologies being controlled by others, and there being a shortage of top scientific talent. There is an urgent need to further enhance the sense of urgency, intensify efforts in scientific and technological innovation, and seize the strategic heights of technological competition and future development.”

China’s lagging position behind the United States in innovation milestones such as mRNA vaccines, advanced semiconductors, and generative AI – which are all underpinned by American strengths in fundamental research – further illustrate some of the gaps in China’s innovation value chain. U.S. leadership in fundamental R&D and scientific breakthroughs however is not to be taken for granted – Beijing is mobilizing all of its national resources for tech supremacy. In March, Beijing signaled its intention to raise national R&D spending by about 10 percent, continuing a trend since 2018, where Beijing has injected over $13 billion USD into R&D. China's investment in R&D has grown more rapidly than its gross domestic product (GDP). For instance, in 2023, China allocated 2.64 percent of its growing GDP to R&D, which accounts for slightly less than the 2.72 percent collectively spent by the countries in the Organisation for Economic Co-operation and Development (OECD). However, despite the outpouring of funding, Beijing still lags behind the U.S in R&D expenditure. In 2022, the United States spent 3.44 percent of its GDP on R&D.

Building a “New National Innovation System”

In Xi’s June speech, he also underscored the need for China to “adhere to the path of independent innovation with Chinese characteristics” while “stimulating innovation vitality through deepening reform.” To address persistent gaps in China’s innovation ecosystem, PRC leaders have acted under increased urgency to reform each segment of their domestic R&D value chain. Last March, Ministry of Science and Technology Deputy Secretary-General He Defang co-authored a detailed essay outlining his thinking about building China’s new “national innovation system (国家创新体系).” He described in the article a systematic re-factoring of China’s innovation engine, one in which barriers to innovation and fundamental research are lowered at each layer of the chain, the siloes separating government, industry, and academia are removed; and each link in the chain is empower to play its role, while all being guided by the strategic directives of the Chinese Communist Party (CCP).

In Pillar I of SCSP’s Vision for Competitiveness report, we highlight the need for the United States to organize national S&T programs and highlight the importance of forging new models of public-private partnerships to reimagine Vannevar Bush’s Science: the Endless Frontier. At its core, Bush’s seminal document underscored the role that fundamental research plays in national security and created new institutions to accelerate the United States’ ability to generate future breakthroughs. In a similar vein, Beijing has been implementing sweeping reforms across its national innovation system, but here we outline two core tasks confronting PRC leaders as they work to realize Xi’s envisioned goal of winning the battle at the frontier of innovation and build a new national innovation system: 1) centralizing control over China’s clunky S&T bureaucratic structure, and 2) creating more agile R&D funding mechanisms.

Centralizing Control over a Sprawling S&T Bureaucracy

Over the past five years, key organizational issues have plagued Beijing’s S&T apparatus. First, at the highest levels of the CCP, there were four separate State Council bodies assigned the responsibility to oversee China’s science and technology policy and strategy. Second, on the government side of the PRC system, interagency turf battles were rampant across government institutions nominally charged with implementing the country’s S&T priorities. Finally, China’s state-backed laboratory system, although inspired by the U.S. National Laboratory System, faced bureaucratic gridlock due to mismanagement of funding and resources for Beijing's National Labs. The situation was no better for the subnational State Key Labs, which had ballooned to over 540 laboratories, resulting in uncoordinated management and duplicative research. To rectify this, Beijing has undertaken a significant organizational restructuring of its S&T enterprise – an initiative that is still ongoing today – with the goal of both centralizing control within the CCP, streamlining the S&T bureaucracy, and taking power away from subnational players in the PRC innovation system.

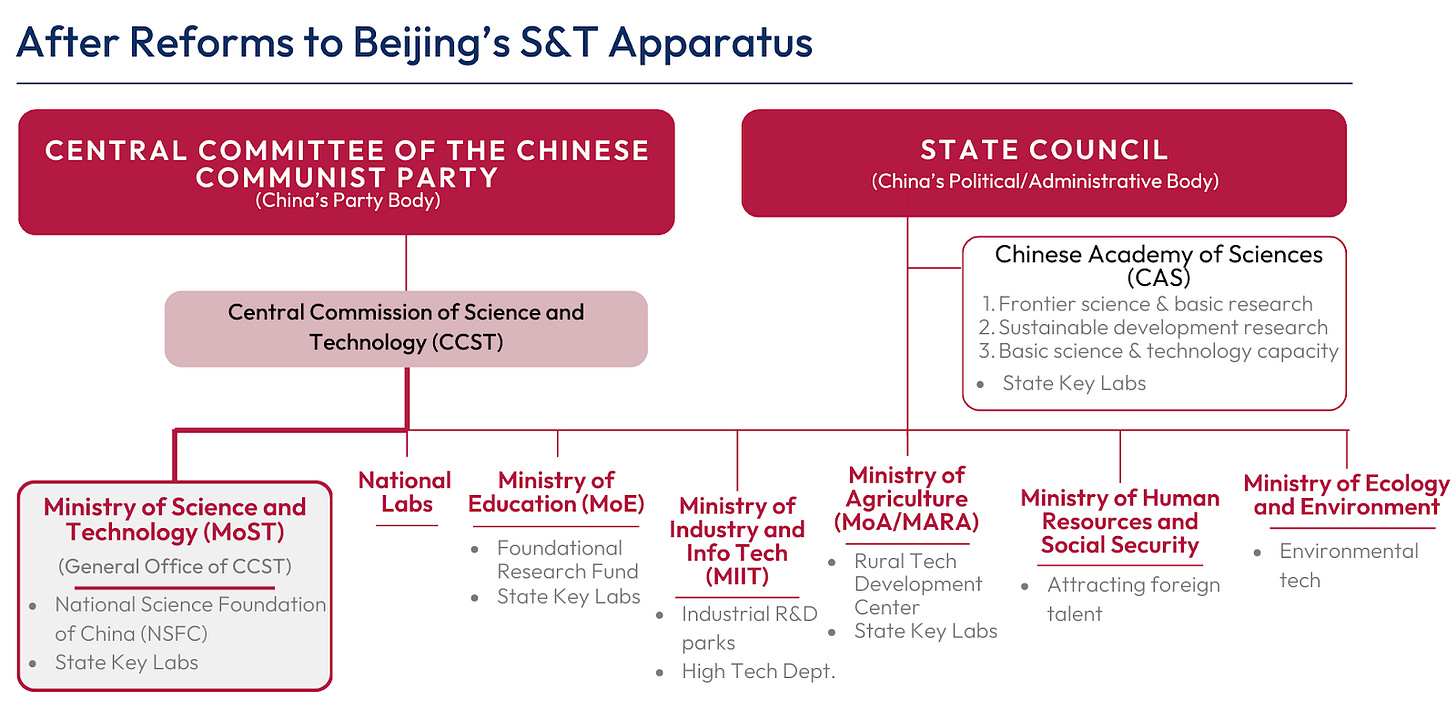

These non-exhaustive charts of key PRC S&T players reflect the recent organizational changes and highlights newly created entities and existing programs within China's national innovation system. China's State Key Laboratories (SKLs) are technically overseen by the Central Commission on Science and Technology (CCST), but their day-to-day management is handled by a number of other government and CCP bodies (see charts below for additional information).

Establishment of a Centralized S&T Party Organ: In March 2023, Beijing created the Central Commission for Science and Technology (CCST) to serve as the central party organ to not only oversee China’s Ministry of Science and Technology (MoST), but all science and technology policymaking bodies. While much of the CCST’s composition and operations remain shrouded in secrecy, its impact can be seen rippling throughout the rest of the PRC national innovation system.

Refocusing Government Ministries on Core S&T Missions: The creation of the CCST as the lead S&T Party entity had ripple effects through the government-side of the PRC S&T apparatus. MoST was perhaps most directly impacted by the establishment of the CCST, being appointed to serve as the CCST’s General Office, running the Commission’s day-to-day operations. In this move, MoST was also likely bureaucratically empowered to implement sci-tech policy across other government ministries. While MoST oversees the National Science Foundation of China (NSFC) - the largest basic research funder in China – MoST was also stripped of any duties that might distract it from its primary S&T R&D mission. Functions related to agricultural tech, environmental tech, and biotech were moved to other ministries and offices. MoST was also stripped of its management of China’s high-tech industrial parks, with the portfolio handed to Ministry of Industry and Information Technology (MIIT), a move likely signaling the Party’s intention to more clearly delineate lanes in the road for the two competing ministries with MIIT to focus on technological commercialization while MoST to focus on fundamental research under the new national innovation system.

Reining in China’s Sprawling State Research Lab System: Over the past decade, top officials have aggressively pushed for the growth of State Key Labs (SKLs, 国家重点实验室). From 2014 and 2018, the number of SKLs increased from 366 to 501, at an average of 27 new SKLs per year. While MoST is formally tasked with overseeing all SKLs, different central ministries operate the day-to-day operations of each SKL. This uncoordinated expansion created mismanagement, overlapping priorities, and ultimately wasted money and resources. Under the current restructuring, there has been a significant slowdown in the buildout of SKLs, now with an emphasis on quality over quantity. One reform has been to repurpose several SKLs into a new type of lab known as National Key Laboratories (全国重点实验室), or NKLs. The focus of these NKLs aims to remove duplicative work, promote new innovative ideas, and ensure that their research solves real-world problems.

Developing More Party-Directed, Innovation-Focused Funding Mechanisms

China's substantial financial investment in its S&T apparatus has been hampered by several factors. PRC leaders’ bias toward project-based funding has meant that researchers and funders have been more averse to placing bets and taking risks. Second, China’s powerful state-owned enterprises (SOEs) account for 25 percent of the country’s GDP, and even though they serve as economic stabilizers in terms of baseline productivity and employment, their innovative capabilities are notoriously poor. Finally, even though the past decade has seen the extraordinary growth of PRC private technology and venture capital firms, these private sector stakeholders had leaned heavily on deploying and scaling mature commercial technologies, contributing little to early stage, deep, and fundamental research. As part of the effort to build a new national innovation system, Beijing has begun experimenting with new funding structures, incentives, and measures to move toward the frontiers of R&D.

Injection of More Stable Funding Sources: Beijing has historically favored project-based funding, as it better allows the Party to funnel funds directly to projects that advance national strategic goals; but the long-term prioritization of project-based funding has created an unfavorable environment for researchers to pursue innovative breakthroughs. The typical 3-5 year project-based funding cycle can also force researchers to abandon projects prematurely, or start seeking other sources of funding before fully completing their research. CCP officials have highlighted the need to address the imbalance between project-based and stable funding for basic research. Currently, the split is heavily skewed towards projects, with over 70% of central government funding allocated that way, compared to just under 30% for stable sources. Ministries such as the Ministry of Education (MoE) have increased government funding for its Fundamental Research Fund, which has steadily increased since the program formally launched in 2016.

Igniting Innovation at State-Owned Enterprises: Beijing’s SOEs play an important role in enabling the CCP to maintain unique control over the economy, but they have fallen far short of helping China push the frontiers of S&T innovation. By serving as monopolies in key industries like energy and transportation, they have removed the competitive pressure to innovate. SOEs’ propensity to prioritize job security and stable salaries over attracting top talent motivated by innovation combined with government regulations limiting hiring flexibility and operational agility, SOEs have become laggards in terms of S&T innovation. That said, PRC leaders are continuing to implement a range of mixed-ownership reforms and employee stock ownership programs to motivate employees and improve internal management and corporate governance.

One program in particular, the Technology Reform Demonstration Action (TRDA), launched in 2020, has targeted tech-focused SOEs with expanded financial incentives to innovate. While the TRDA program has shown some early signs of success, such as bolstering R&D intensity, and successfully reignited talent recruitment, persistent questions remain whether these reforms will have a meaningful impact over the long-term.

Attracting More Private Capital for Fundamental Research: Against the backdrop of a broader economic slowdown, Beijing is refining new incentive mechanisms to push its growing private technology firms and private capital stakeholders to invest more in early stage research. Private companies in China are significantly underinvested in basic research, compared to other innovation powers such as the United States. In a 2021 survey among PRC tech firms based in Zhejiang Province – home to China’s tech giants like Alibaba and Netease – almost all of the 113 companies surveyed indicated an interest in developing future technologies, but 94 of the firms noted that they prioritized technologies with a 3-5 year commercialization cycle. Only 14 of the 113 companies indicated they were working on technologies with commercialization cycles longer than 10 years. While this survey only explores the sentiments of one of China’s more tech-forward provinces, it is indicative of a nation-wide shortfall in proper incentive structures.

Since 2018, Beijing has had mixed success capturing private firms and private capital’s attention in fundamental research and deeptech. Beijing has issued policy changes aimed at clarifying tax breaks for basic research contributions to public research institutions and established joint funds where companies contribute and receive matching funds for basic research. There are some early signs that private firms in China are starting to take deeptech more seriously.

Paving the Road Toward Industries of the Future

China's ambitious plan to become a leader in future innovation faces a crucial hurdle: reconciling its centralized control with science and technology's need for open discovery. This clash between top-down authority and bottom-up exploration will determine if China reaches its full innovation power potential. As Beijing refocuses on sowing the seeds of success for the “innovative development of future industries,” the key strategic pieces to winning the technology competition will be getting its S&T apparatus appropriately organized and its funding mechanism bottlenecks streamlined.

Returning to Xi's June address at the national science and technology conference in Beijing, PRC leadership recognizes the crucial role of foundational research in driving invention, which in turn fuels a nation's innovative capacity. Xi talked about his vision for a "strong science and technology nation," prioritizing "strong basic research and original innovation capabilities," as the first among the nation’s priorities for continuous breakthroughs in science and technology.

In light of China's mobilization to be a global S&T superpower, the United States should avoid complacency and actively strive to maintain its leading edge in innovation. Read more about how the United States should reimagine the Endless Frontier in Pillar I of SCSP’s Vision for Competitiveness: Mid-Decade Opportunities for Strategic Victory.

The AI+ Summit Series

ICYMI, SCSP recently announced the AI+ Summit Series, a set of high-level events dedicated to enabling rapid advancements in artificial intelligence (AI) as it transforms our country and becomes a keystone of our national security.

The AI + Energy Summit, the first in this series, will take place on September 26, 2024, in Washington, D.C.