Hello, I’m Ylli Bajraktari, CEO of the Special Competitive Studies Project. In this week’s edition of 2-2-2, SCSP’s David Lin, Olivia Armstrong, and the Future Technology Platforms team revisits their 2022 “Gaps” Analysis and highlights how the competitive landscape has shifted in three strategic technology areas, what wildcards could alter their trajectory, and what to watch for over the horizon.

📌 SCSP Events on the Horizon

October 23 - SCSP’s second AI+ summit, the AI+ Robotics Summit will take place in Washington, D.C. Sign up for our waitlist here!

November 1 - The Ash Carter Exchange in Boston, MA. Join the waitlist here!

November 15 - SCSP x AGI House Hackathon: SCSP is partnering with the Bay Area AI hacker house, AGI House, to host an AI Agents for Gov Hackathon @SCSP’s office in DC! Come create the future of AI agents to solve important real-world challenges. Stay tuned for more details!

Mind the Gaps: Three Updates to Our 2022 Technology Assessment

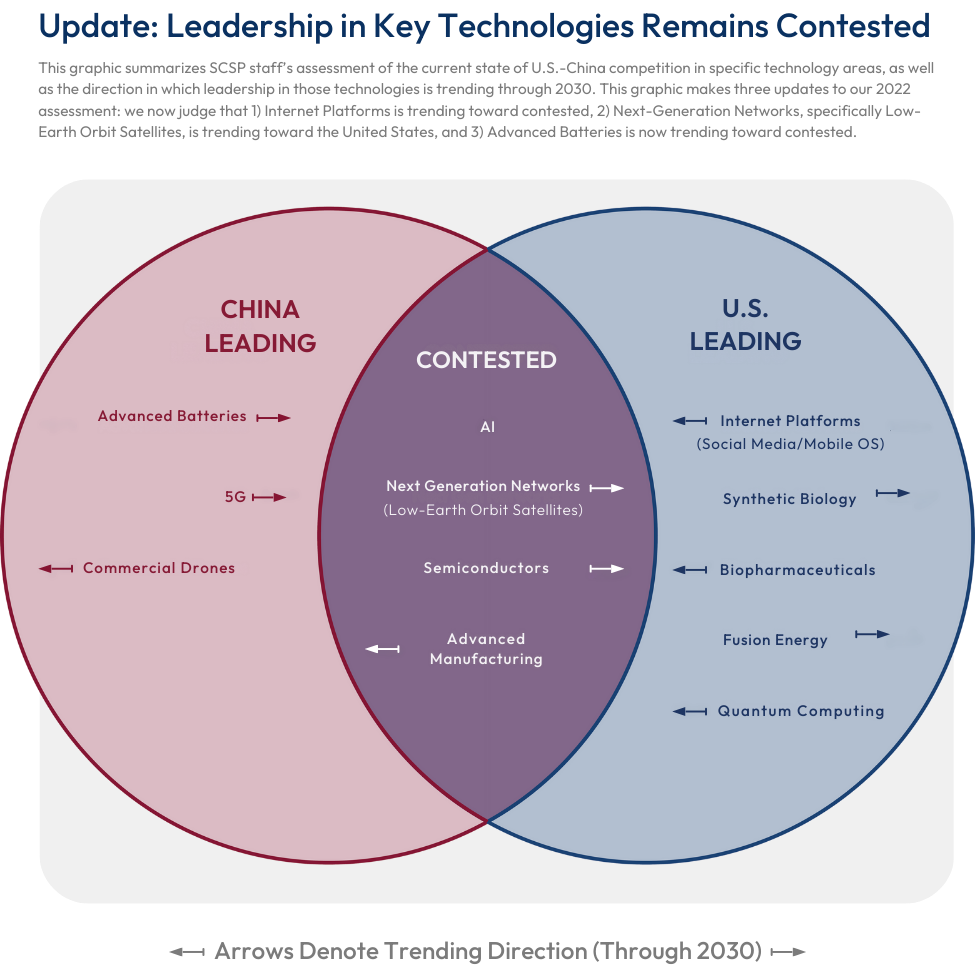

In 2022, SCSP conducted a gap analysis (“Gaps 1.0”) of twelve technology areas that we believed would drive the competition between the United States and China from 2025 to 2030. These twelve tech areas are derivatives of a broader set of strategic sectors we judge to be central to building national competitiveness (Mid-Decade Challenges to National Competitiveness).

Our methodology used a framework of analytic questions to select and examine these tech areas through three lenses: tech phenomena, competition factors with China, and the state of the U.S. innovation ecosystem (Platforms Interim Panel Report). We assert that the evidence selected for these conclusions should be a mix of quantitative and qualitative metrics of actual fielded capabilities that differ for each technology, using secondary variables like publication trajectories as indirect proxies for understanding real positional advantages.

Here in “Gaps 2.0,” we’re highlighting three noteworthy changes among the twelve technology areas that we initially examined: Internet platforms (e.g. social media and mobile operating systems), advanced battery technologies, and next-gen networks (e.g. low-earth orbit satellites). We assessed the competitiveness of the other nine areas remained the same. Stay tuned as we plan to do similar gaps analysis for other technology areas in the coming months.

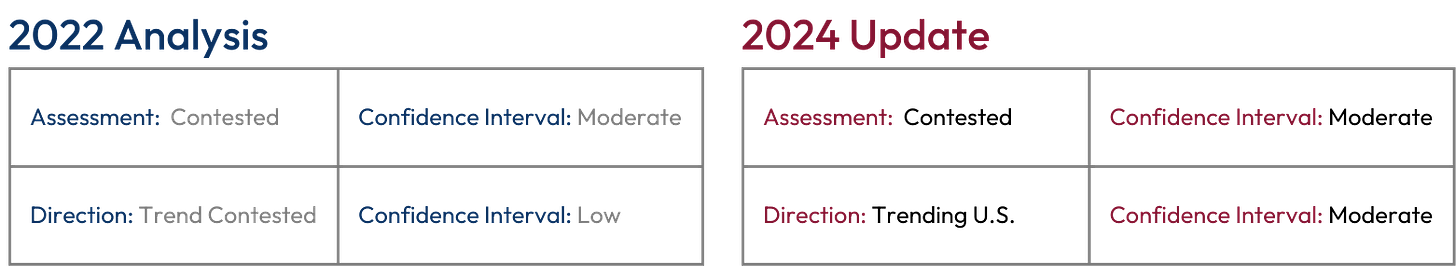

Internet Platforms (Social Media/Mobile OS)

The United States Leads, But New PRC Platforms Are Catching Up: Overall, U.S. Internet platforms maintain a lead in terms of overall market capitalization, and the majority of the global population uses them to connect, communicate, and find information. U.S.-based social media companies hold the top four spots in monthly active users worldwide as of July 2024, and Google had 91% of the global search engine market share in August 2024. But the steady emergence of new PRC mobile applications onto the global stage over the past two years, coupled with the Chinese Communist Party’s (CCP) increasing calls for self-reliance in both hardware and software have shifted our outlook.

The emergence and meteoric rise of new PRC Internet platforms – particularly Bytedance’s TikTok, one of the top social media applications among the youth demographic in North America, second only to Instagram – shows that China’s success in this sector was not a fluke, but rather the beginning of a larger trend. Capcut, a video editing tool, also a product of Bytedance, became the fifth most popular app in 2023. PRC e-commerce apps, such as Temu and Shein, have skyrocketed in popularity among global Internet users. Notably, Temu, whose parent company is TDD Holdings, now sits among the top 10 most popular apps in 2023. Even new PRC AI startups, like Moonshot.ai and Minimax, have gained a sizable following in the United States, with Minimax’s AI chat app “Talkie” boasting 11.4 million monthly active users as of May, a tripling of the same figure from April.

Wildcards: One of the biggest imbalances in this space is that virtually all U.S. Internet platforms are barred from operating in the Chinese market while PRC platforms are able to operate freely in the United States – at least for now. That is likely to change, as the U.S. government is beginning to implement policies aimed at limiting the influence of Chinese Internet platforms within its borders. The White House, for example, recently announced a new proposal that would eliminate a customs loophole that Shein and Temu have exploited to import millions of dollars’ of low-value items into the United States tariff-free. Congress is considering similar legislation. The saga of Tiktok, which is facing potential divestment or a ban, underscores the escalating scrutiny and uncertainty surrounding Chinese-owned Internet platforms in the United States. This case – and the precedent that it will set – also illuminates the challenges of isolating a Chinese-origin mobile application from the broader U.S. tech ecosystem, especially after it has established a significant domestic U.S. user base.

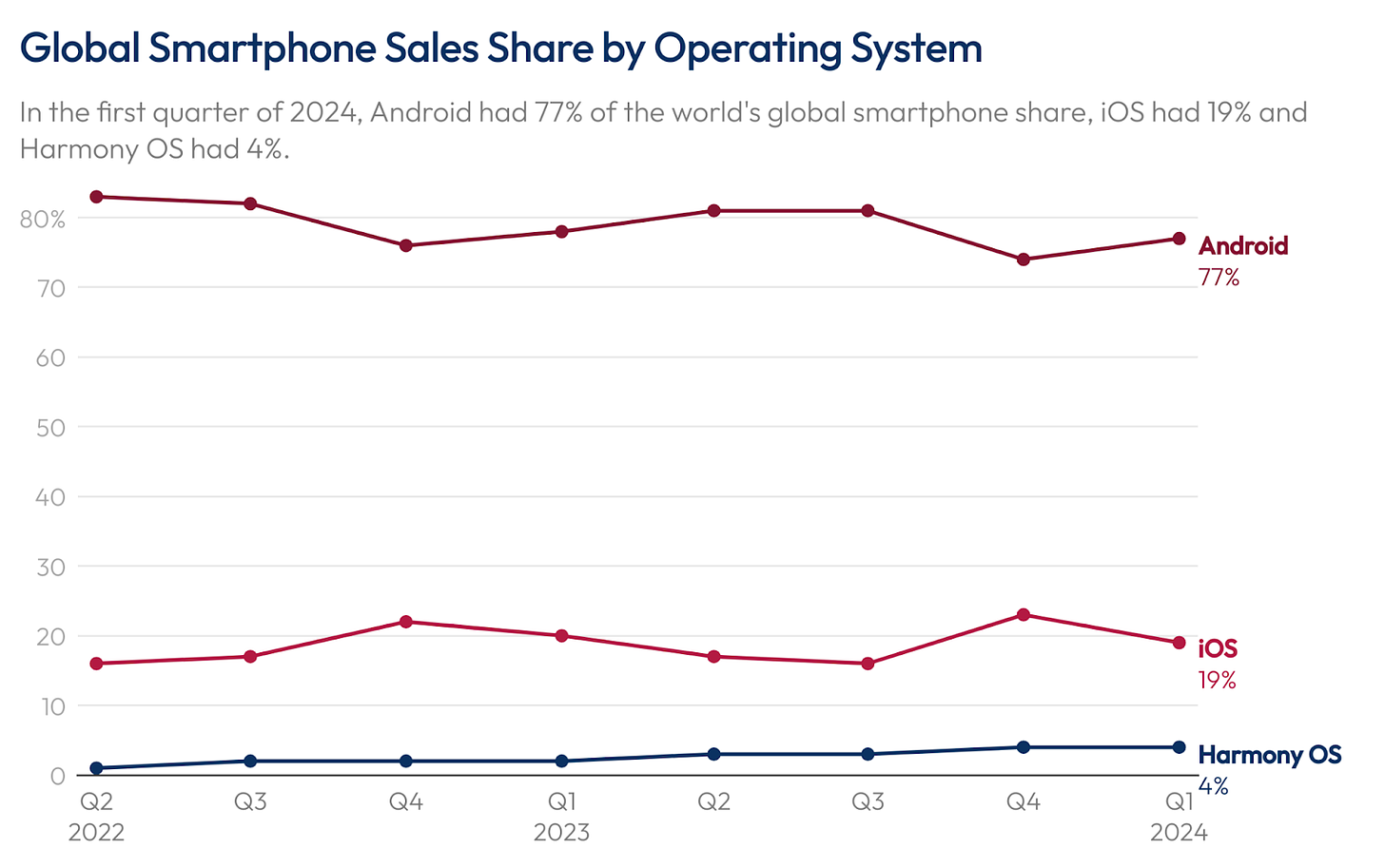

What to Watch: China’s Huawei is making a play to build an alternative mobile application ecosystem, a space long dominated by Apple’s App Store and Google’s Play Store. Whereas previous versions of Huawei’s mobile operating system were based on open-source Android and operated on a Linux kernel, the PRC tech giant is planning to launch the beta version of its first “pure blood” mobile operating system in China on October 8th.

The new operating system is reportedly built with completely indigenous code, independent from open-source Android. Huawei’s existing mobile operating system, HarmonyOS, recently overtook Apple’s iOS as being the second most used mobile operating system in China, after Android. Currently, about 700 million devices run on HarmonyOS and 2.2 million third-party developers are creating apps for the platform (presumably largely inside China). HarmonyOS NEXT has a long road ahead before posing a serious global challenge to Apple and Google, but its development will be a noteworthy milestone in addressing one of China’s long-perceived gaps in mobile operating systems, a key vulnerability identified by a prominent PRC think tank report in 2022 that was subsequently censored.

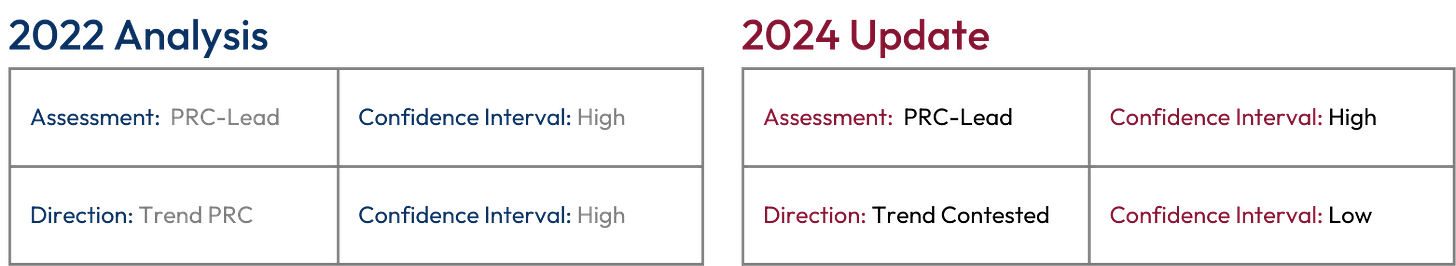

Advanced Batteries

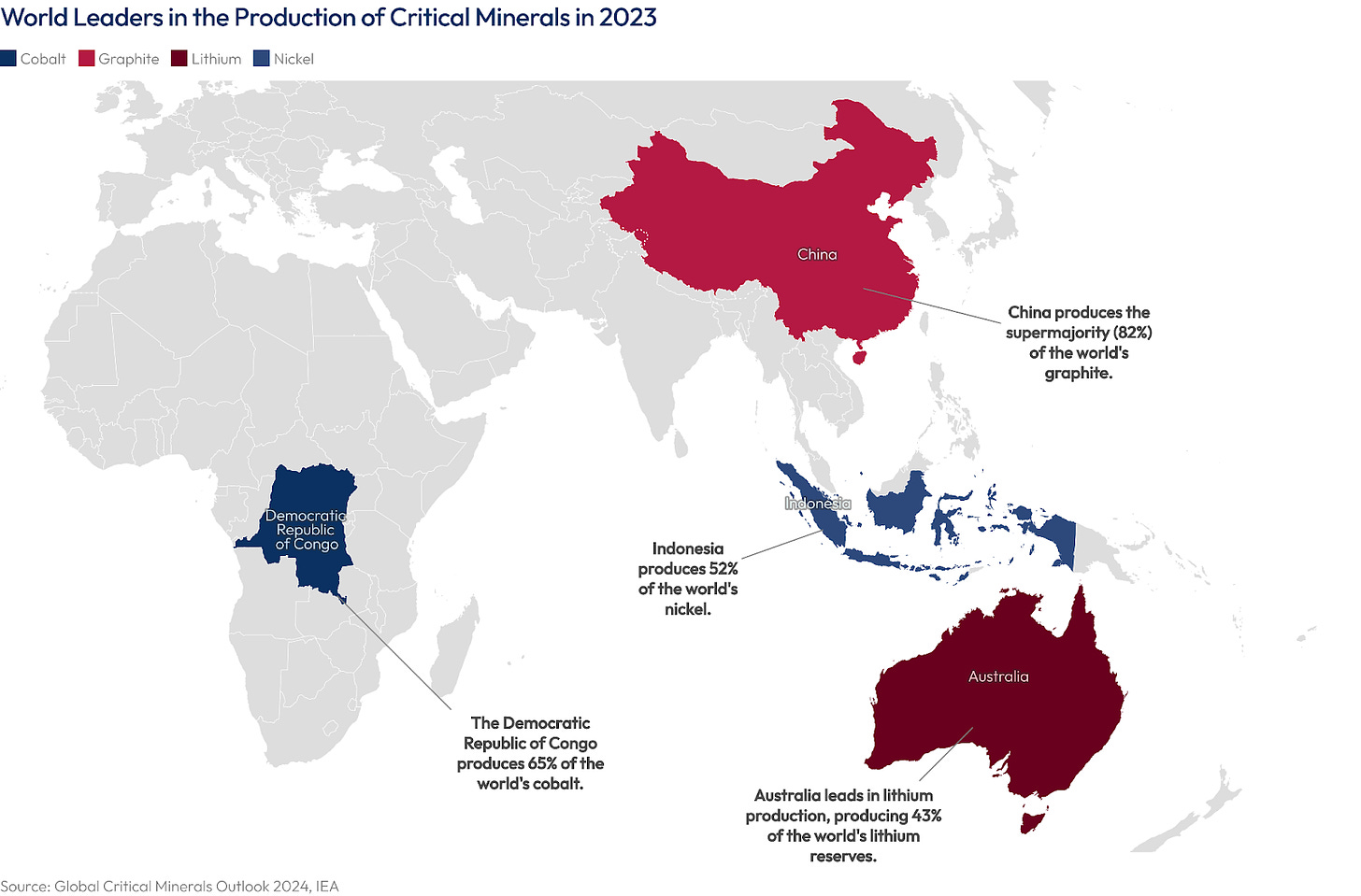

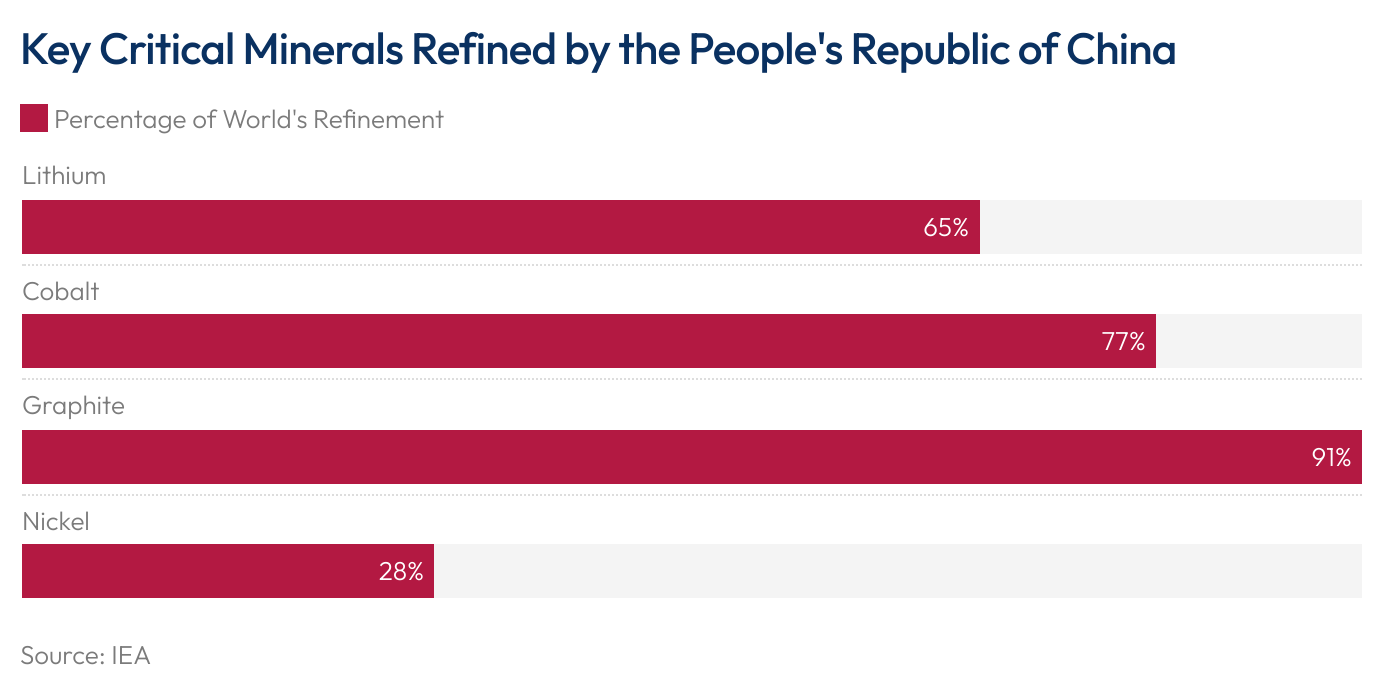

China is Still Dominant, but the United States Is Making Strategic Investments: Since 2022, China has continued to lead in multiple aspects of advanced batteries, maintaining its grip on the battery supply chain through the refinement of critical minerals. The PRC also has a dominant position in battery production capacity. The leading high-capacity batteries also remain lithium-ion based, using predominantly cobalt, nickel, and lithium. As of 2023, the production of critical minerals remains spread across several countries. Australia leads with 43% of lithium production, Indonesia with 52% of nickel, the Democratic Republic of Congo with 65% of cobalt, and China with 82% of graphite production. China continues to dominate the processing of three out of the four critical minerals for battery production and is looking for unique ways to bolster its lead. In 2023, the PRC refined 65% of the world's lithium, 77% of cobalt, and 91% of graphite. In nickel refinement, China accounted for 28%, second only to Indonesia’s 37%.

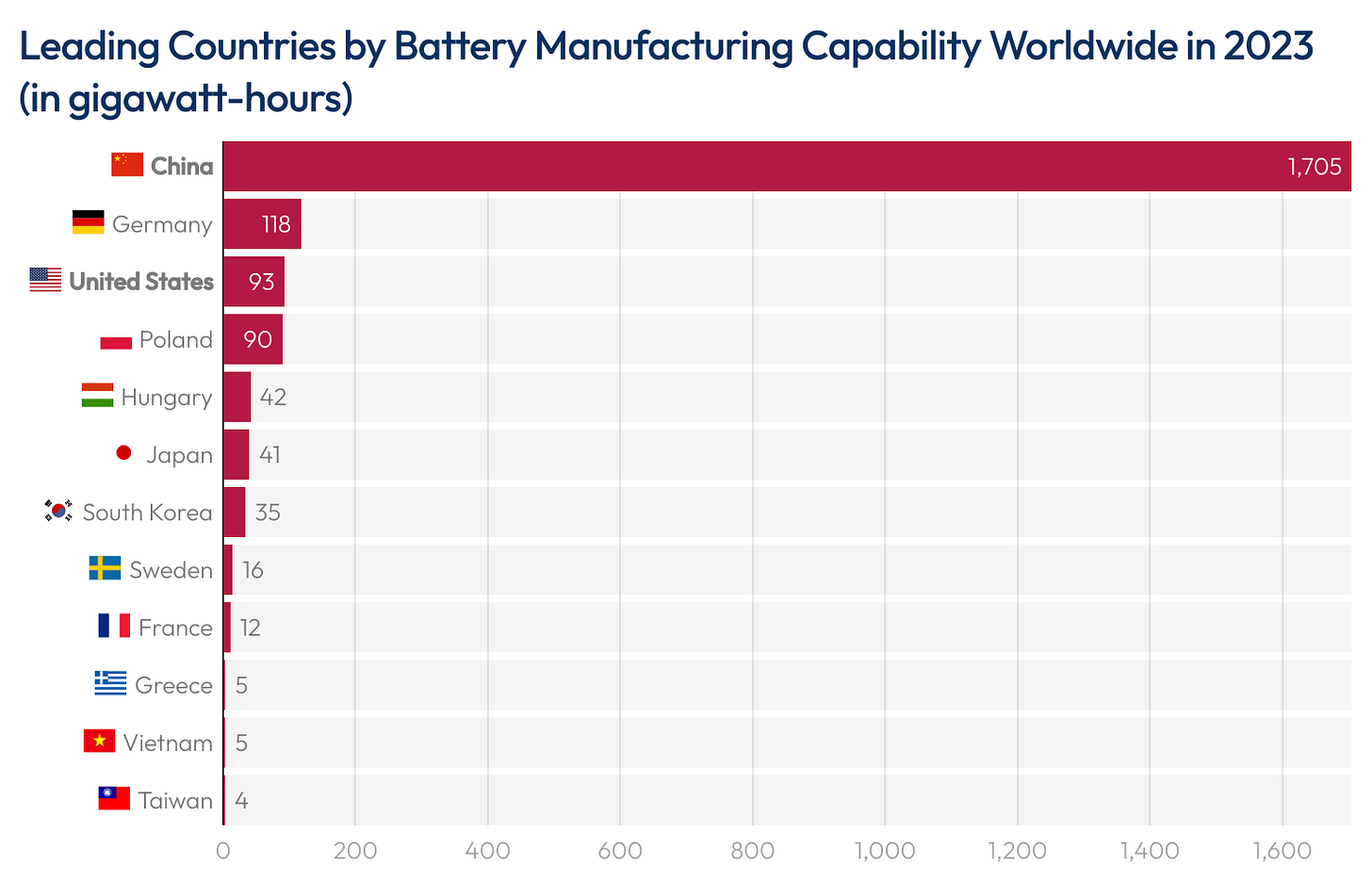

China’s battery manufacturing capacity also remains unmatched globally, producing 1,705 gigawatt-hours (GWh), compared to the U.S’ 93 GWh in 2023. China is especially dominant in manufacturing lithium-ion batteries. China supplies 90% of the world's batteries, accounting for approximately 60% of the global EV battery market. Chinese companies such as CATL and BYD are still the top EV battery manufacturers, accounting for almost 53% of global market share. U.S.-based companies, however, do not rank among the top 10 global EV battery makers. However, since our last analysis, there has been a significant effort to bolster the United States’ competitiveness in the battery supply chain.

The 2022 Inflation Reduction Act (IRA), aims to reduce U.S. reliance on China for batteries by offering tax credits to companies that manufacture them domestically. The IRA is one of the key factors that pushed us to modify our 2022 assessment. Starting in 2024, 60% of battery components must be produced or assembled in North America to qualify for half the credit, rising to 100% by 2029. In 2023, the IRA spurred investments and reduced domestic battery costs by $45/kWh, increasing projected U.S. market capacity. However, the United States still lags behind China in all aspects of the battery supply chain, including mineral production. The IRA's focus on mineral recycling and tax credits, alongside the Bipartisan Infrastructure Law (BIL) is a step toward addressing this deficiency. The BIL also aims to boost the domestic supply chain by encouraging increased production across advanced batteries and battery materials. Between the two laws, $1.8 billion dollars have been awarded to 14 projects that will build and expand commercial-scale battery processing and recycling facilities. Tax credits have also been awarded to 100 projects across 35 states for clean energy manufacturing and projects for refining, processing, and recycling critical materials. Notably, the United States is working to strengthen the battery supply chain alongside allies and partners through recent initiatives such as the Minerals Security Partnership (MSP) and the Indo-Pacific Economic Framework for Prosperity (IPEF). These initiatives aim to bolster the battery supply chain by promoting responsible sourcing and investment in critical minerals among members. The continued prioritization and investment into the United States’ battery industry will be critical to reduce dependence on China.

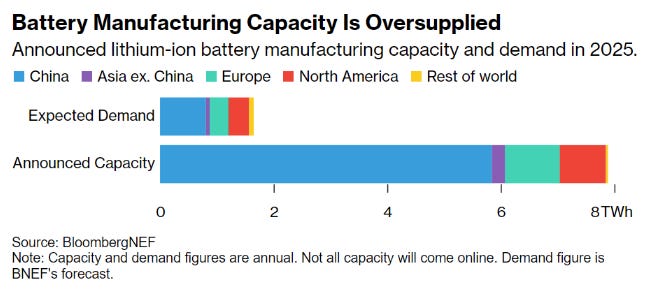

Wildcards: While China's dominant position in battery production is impressive, it's accompanied by the prospect of significant overcapacity as the world transitions from internal combustion engines (ICE) to electric vehicles (EVs). EVs are by and large driving the demand for today’s advanced batteries and in 2023, China utilized less than 40% of its maximum cell output, and its installed manufacturing capacity for cathode and anode active materials far exceeded global EV cell demand. To alleviate this excess, China has become the world's largest exporter of EV cells, cathodes, and anodes and CATL – China’s largest battery manufacturer – is considering pulling back on lithium production, demonstrating some of the early signs of oversupply amid weak demand. Washington is implementing measures to prevent PRC-made EVs from flooding the U.S. market – including 100 percent tariffs announced in May – and restrictions on PRC-origin interconnected vehicle hardware and software announced in September, two recent examples of these efforts.

What to Watch: AI innovations in battery-related R&D could transform the energy storage sector and will be the lynchpin for the United States and its allies and partners to regain an upper hand in the sector. AI has already accelerated the search for novel battery chemicals, narrowing 32.6 million possibilities to 18 promising candidates in under a week—a task that would otherwise have taken 20 years. Deep learning AI models and programs like the Materials Genome Initiative are unlocking thousands of new materials for future technologies, like the next generation of long-duration energy storage. New public-private partnerships in this space are also showing some promise: an AI-focused partnership between the U.S. government and industry early this year led to the discovery of a new kind of solid-state electrolyte that could cut down the amount of lithium used in a battery by as much as 70 percent. However, the PRC has demonstrated an ability to rapidly move novel battery chemistries into mass production. Additional progress in synthesizing AI-designed materials and scaling production for novel battery chemistries will be critical for the U.S. to catch up.

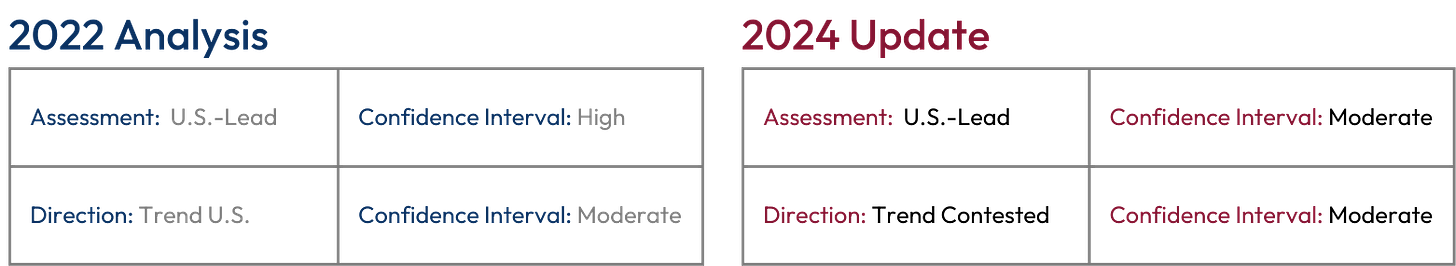

Low-Earth Orbit Satellites (Next-Gen Networks)

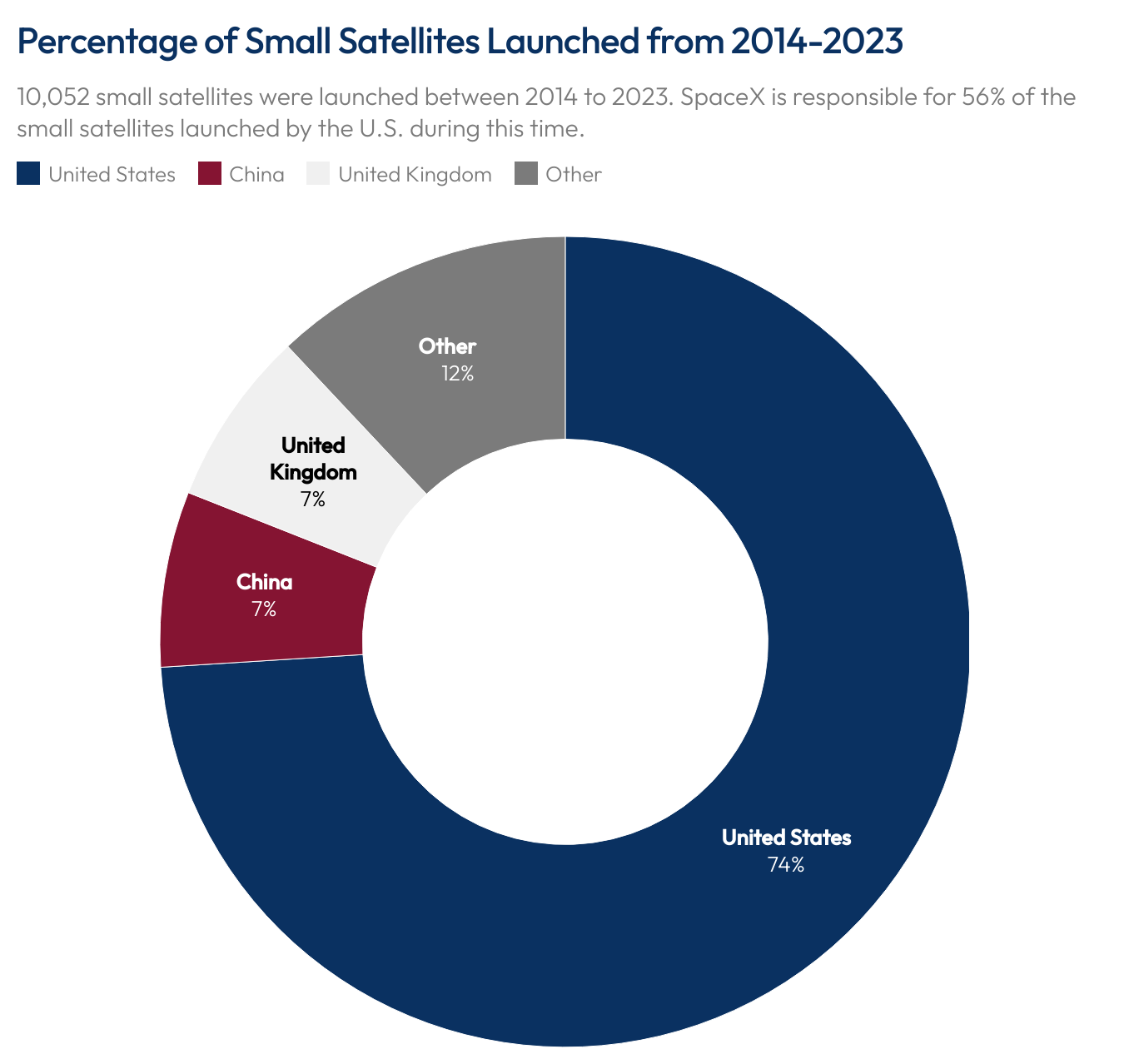

The United States is Making Early Wins in the Path to Future Networks: Non-terrestrial networks (NTNs) will be key to fostering next-generation connectivity and a critical piece of that is low-earth orbit (LEO) satellites. To date, the United States holds a commanding lead in LEO satellite constellations, with Starlink having deployed upwards of 5,000 LEO satellites. Other U.S. and allied companies such as London-based OneWeb and Amazon’s Project Kuiper, have plans to launch more this year. U.S. companies like Starlink and AST SpaceMobile are also taking a global lead in D2D-enabled (direct to device) satellites, which reduce implementation costs via decreased need for the base stations that traditionally serve as interlocutors between LEO satellites and terrestrial networks. Despite Beijing’s strategic prioritization of space technologies, via quantum communications and earlier this year, a successful space mission to the other side of the moon, China is lagging behind in the deployment of LEO mega-constellations. This past August, Beijing launched a set of eighteen LEO satellites to form its own Starlink rival network, the first step in an ambitious plan to launch as many as 40,000 LEO satellites in the next decade.

Wildcards: As the LEO networks market continues to grow and space launches become more widespread, there is a growing issue with debris floating in low earth orbit. Approximately 85 percent of this debris resides within low-Earth orbit and is traveling at high velocities. This debris can cause significant damage to existing satellites, and raises the possibility that the density of debris will render it impossible to safely deploy and operate satellites. This prospect, known as the Kessler effect, can lead to a high number of collisions where the possibility of each collision exponentially increases after each collision. The issue of space debris rose again recently in August with the PRC launch of its Long March rocket, which created upwards of 700 debris fragments. SpaceX has plans to launch a mega-constellation of LEO communications satellites with approximately 42,000 satellites; however, experts say that low earth orbit can only hold 72,000 satellites under the current circumstances before an event triggering the Kessler effect could take place.

What to Watch: Looking at the broader advanced networks sector, the 6G landscape is continuing to take shape with many industry experts anticipating a fuller scaling and deployment of 6G networks in the 2030 timeframe; however, similar to China’s deployment of 5G – China is attempting to stake its claim as the leader of the 6G market. Currently, China has 6,001 6G patents filed, compared to the United States's 3,909. While this technology is still in its early days, the global effort to standardize technological requirements is already underway. Throughout this process, countries will seek to gain early-mover advantages from setting international standards closely aligned with their industry leaders’ current capabilities. On both the technological and standard-setting fronts, the United States will need to ramp up attention for 6G soon, otherwise, it risks losing out to China like it did with 5G.

To read more of SCSP’s comparative or “gaps” analyses in critical technology sectors, check out our “Memo to the President” series of newsletters that accompanied the launch of a number of our SCSP technology action plans:

Advanced Manufacturing Comparative Analysis (June 2024)

Next-Generation Energy Comparative Analysis (February 2024)

Compute and Microelectronics Comparative Analysis (November 2023)

Biotechnology Comparative Analysis (April 2023)